| LOL, looks like the pretend government web page can pretend no more and29-12-2023 02:14 |

Swan ★★★★★ ★★★★★

(5725) |

it gets quieter every time I mention Trumps hidden JFK files that were not found in his home.

Better luck next time, turds.

PS. Happy new year

IBdaMann claims that Gold is a molecule, and that the last ice age never happened because I was not there to see it. The only conclusion that can be drawn from this is that IBdaMann is clearly not using enough LSD.

According to CDC/Government info, people who were vaccinated are now DYING at a higher rate than non-vaccinated people, which exposes the covid vaccines as the poison that they are, this is now fully confirmed by the terrorist CDC

This place is quieter than the FBI commenting on the chink bank account information on Hunter Xiden's laptop

I LOVE TRUMP BECAUSE HE PISSES OFF ALL THE PEOPLE THAT I CAN'T STAND.

ULTRA MAGA

"Being unwanted, unloved, uncared for, forgotten by everybody, I think that is a much greater hunger, a much greater poverty than the person who has nothing to eat." MOTHER THERESA OF CALCUTTA

So why is helping to hide the murder of an American president patriotic?

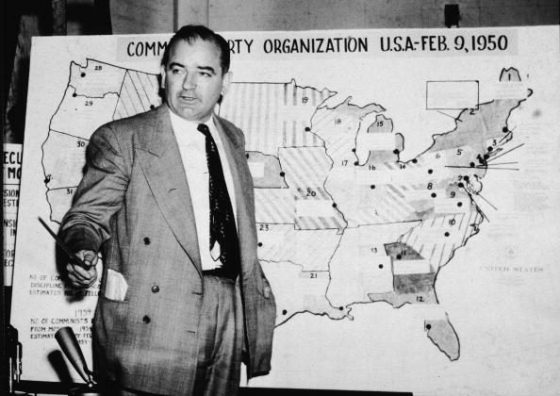

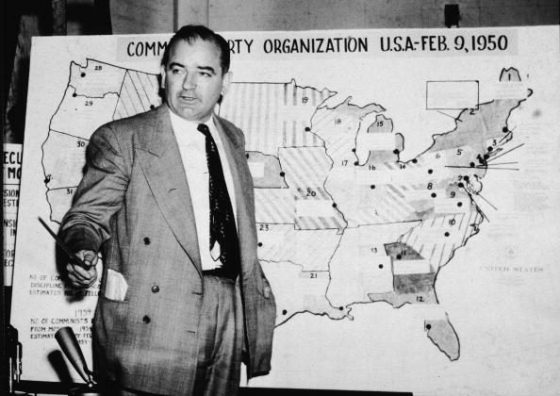

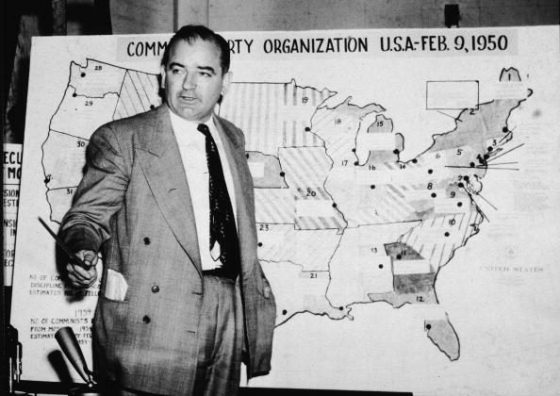

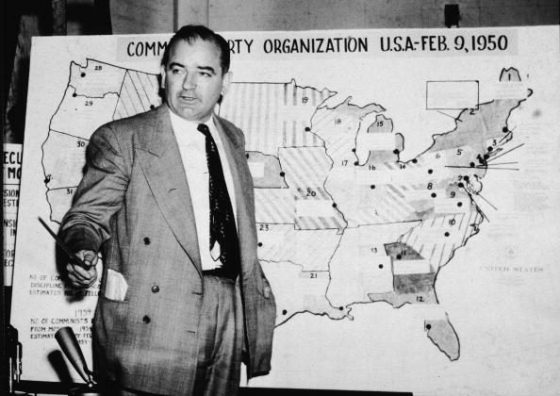

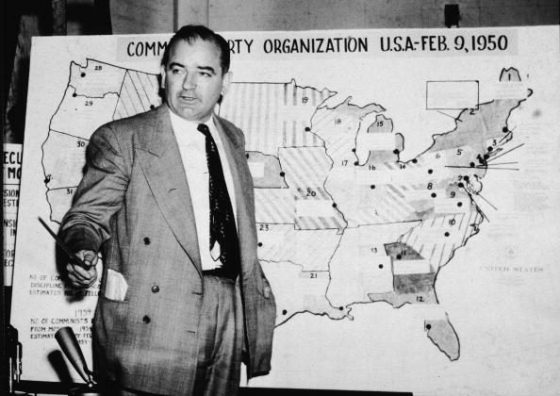

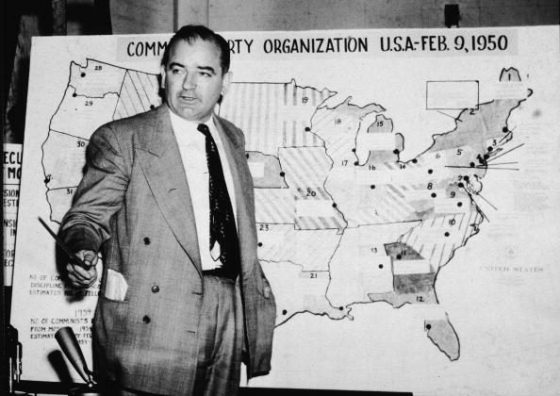

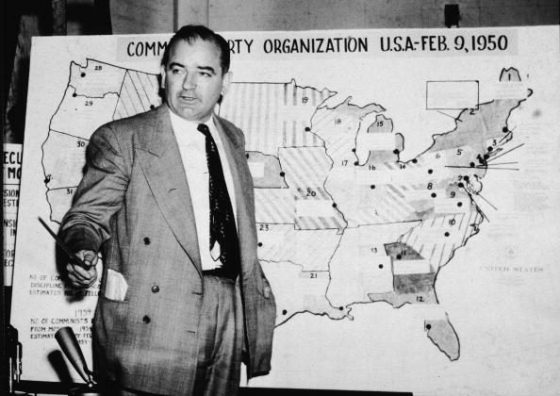

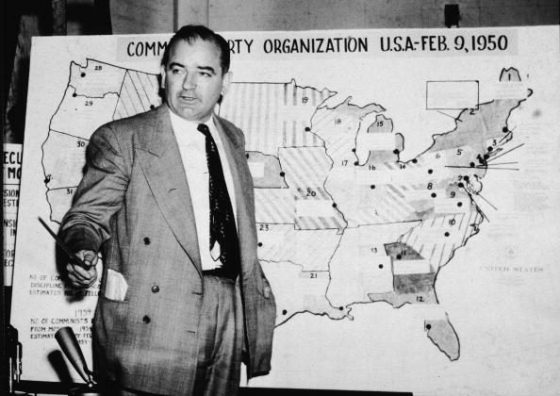

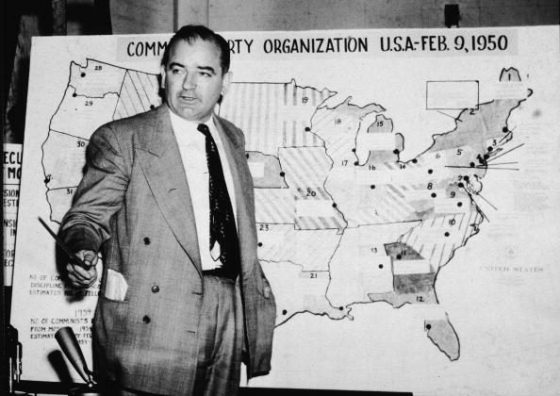

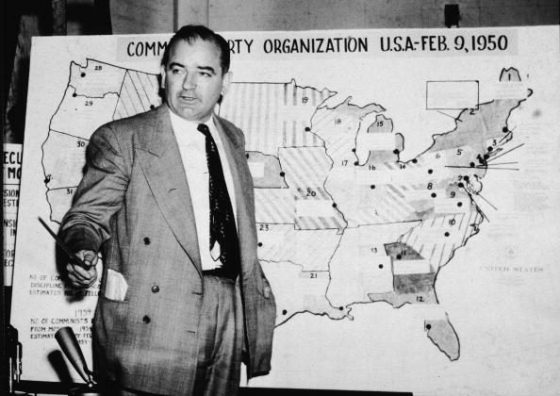

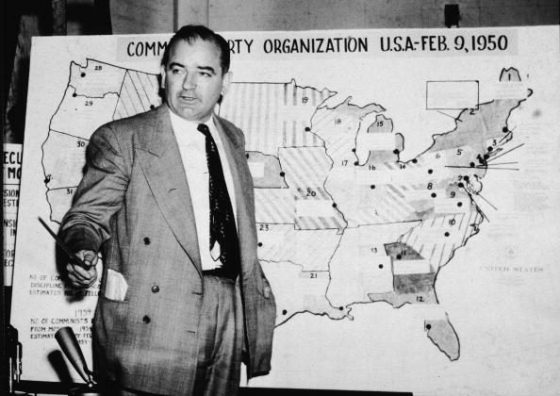

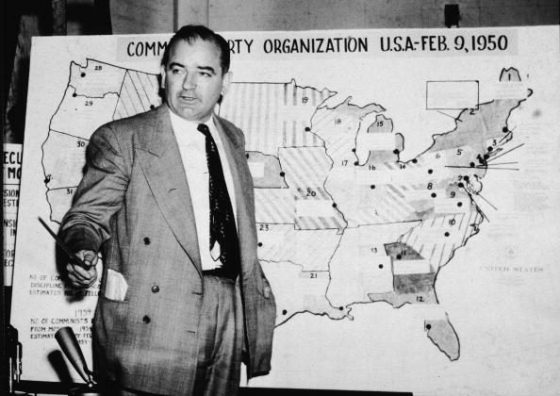

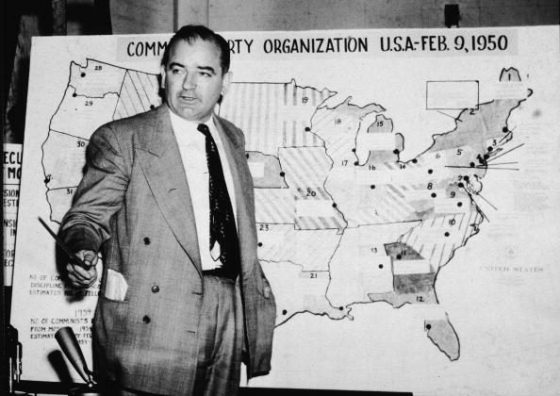

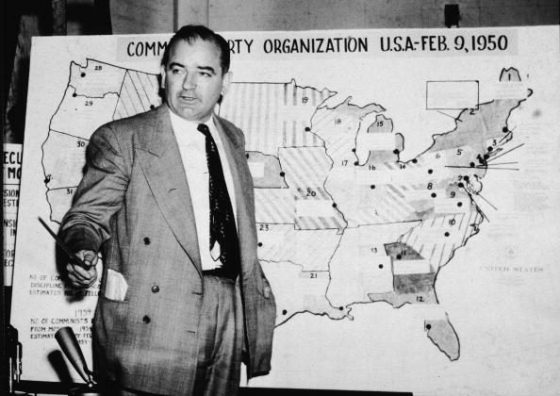

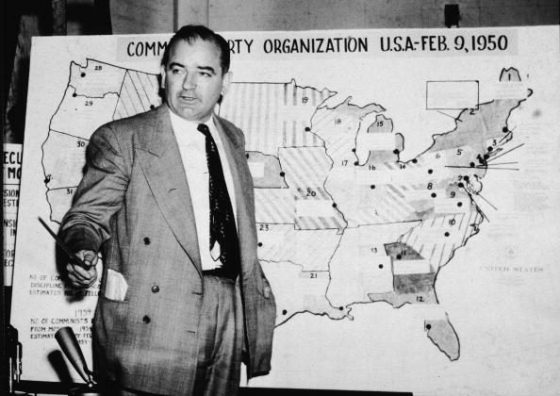

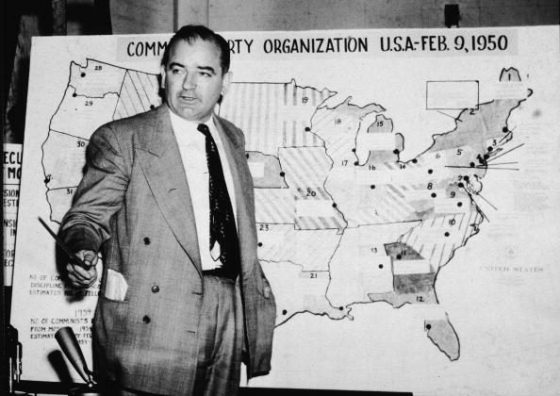

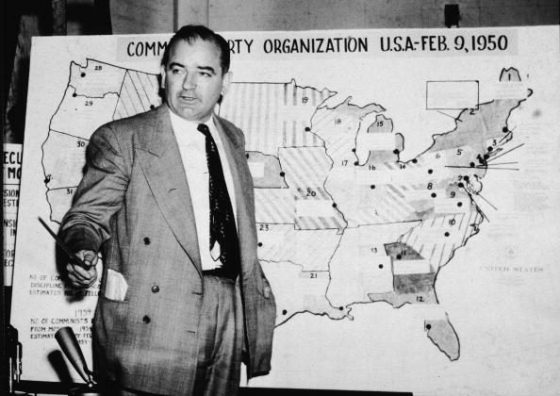

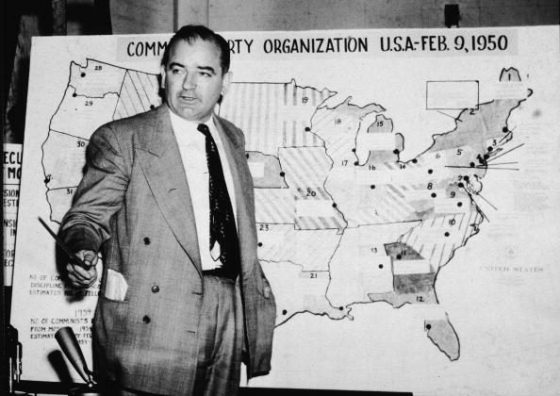

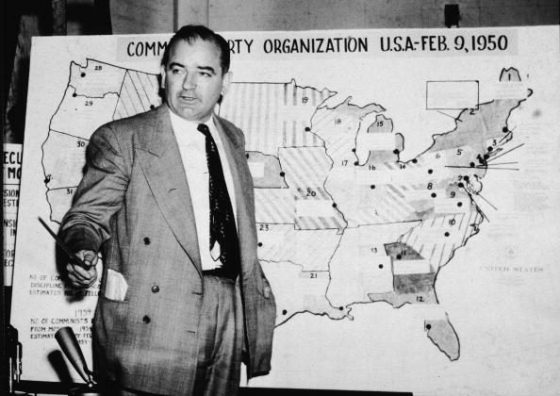

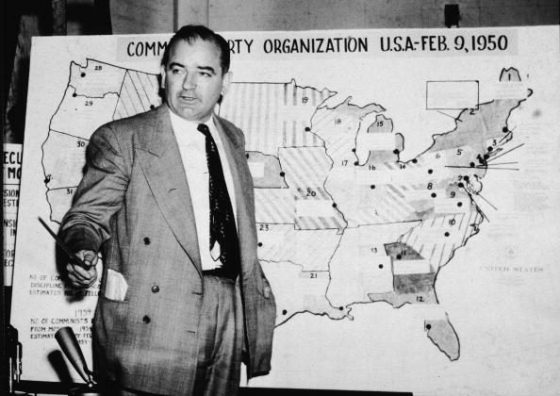

It's time to dig up Joseph Mccarthey and show him TikTok, then duck.

Now be honest, was I correct or was I correct? LOL |

| RE: Government Etymology29-12-2023 05:09 |

Spongy Iris ★★★★☆ ★★★★☆

(1643) |

Swan wrote:

it gets quieter every time I mention Trumps hidden JFK files that were not found in his home.

Better luck next time, turds.

PS. Happy new year

The word government means mind control.

Sheesh nobody here wants to acknowledge the lie of the Kennedy Space Center.

Crickets.

%20(1).png) |

| 29-12-2023 06:52 |

James_★★★★★

(2238) |

Spongy Iris wrote:

Swan wrote:

it gets quieter every time I mention Trumps hidden JFK files that were not found in his home.

Better luck next time, turds.

PS. Happy new year

The word government means mind control.

Sheesh nobody here wants to acknowledge the lie of the Kennedy Space Center.

Crickets.

You need a boyfriend Alan. Go to a gay forum. |

| 29-12-2023 07:42 |

Spongy Iris ★★★★☆ ★★★★☆

(1643) |

James_ wrote:

Spongy Iris wrote:

Swan wrote:

it gets quieter every time I mention Trumps hidden JFK files that were not found in his home.

Better luck next time, turds.

PS. Happy new year

The word government means mind control.

Sheesh nobody here wants to acknowledge the lie of the Kennedy Space Center.

Crickets.

You need a boyfriend Alan. Go to a gay forum.

I checked out 4 Chan, but I didn't like the lay out and conversations.

%20(1).png)

Edited on 29-12-2023 07:42 |

| 29-12-2023 07:52 |

James_★★★★★

(2238) |

Spongy Iris wrote:

James_ wrote:

Spongy Iris wrote:

Swan wrote:

it gets quieter every time I mention Trumps hidden JFK files that were not found in his home.

Better luck next time, turds.

PS. Happy new year

The word government means mind control.

Sheesh nobody here wants to acknowledge the lie of the Kennedy Space Center.

Crickets.

You need a boyfriend Alan. Go to a gay forum.

I checked out 4 Chan, but I didn't like the lay out and conversations.

It takes time to get to know people. With what forum you choose, you'll probably

find they'll like you. I don't like Americans yet... |

|

| 29-12-2023 13:39 |

Swan ★★★★★ ★★★★★

(5725) |

James_ wrote:

Spongy Iris wrote:

Swan wrote:

it gets quieter every time I mention Trumps hidden JFK files that were not found in his home.

Better luck next time, turds.

PS. Happy new year

The word government means mind control.

Sheesh nobody here wants to acknowledge the lie of the Kennedy Space Center.

Crickets.

You need a boyfriend Alan. Go to a gay forum.

Actually you are the clear closet fag who loves his father Alan and despises the church who will not molest him like happens in his fantasy.

So, like I said and you just proved, this fake government undercover website is a failure, making a few lame posts when I laugh does not change this fact.

IBdaMann claims that Gold is a molecule, and that the last ice age never happened because I was not there to see it. The only conclusion that can be drawn from this is that IBdaMann is clearly not using enough LSD.

According to CDC/Government info, people who were vaccinated are now DYING at a higher rate than non-vaccinated people, which exposes the covid vaccines as the poison that they are, this is now fully confirmed by the terrorist CDC

This place is quieter than the FBI commenting on the chink bank account information on Hunter Xiden's laptop

I LOVE TRUMP BECAUSE HE PISSES OFF ALL THE PEOPLE THAT I CAN'T STAND.

ULTRA MAGA

"Being unwanted, unloved, uncared for, forgotten by everybody, I think that is a much greater hunger, a much greater poverty than the person who has nothing to eat." MOTHER THERESA OF CALCUTTA

So why is helping to hide the murder of an American president patriotic?

It's time to dig up Joseph Mccarthey and show him TikTok, then duck.

Now be honest, was I correct or was I correct? LOL |

| 29-12-2023 13:42 |

Swan ★★★★★ ★★★★★

(5725) |

James_ wrote:

Spongy Iris wrote:

James_ wrote:

Spongy Iris wrote:

Swan wrote:

it gets quieter every time I mention Trumps hidden JFK files that were not found in his home.

Better luck next time, turds.

PS. Happy new year

The word government means mind control.

Sheesh nobody here wants to acknowledge the lie of the Kennedy Space Center.

Crickets.

You need a boyfriend Alan. Go to a gay forum.

I checked out 4 Chan, but I didn't like the lay out and conversations.

It takes time to get to know people. With what forum you choose, you'll probably

find they'll like you. I don't like Americans yet...

If you do not like America, you are free to leave, so please do as no one is forcing you to be here. And take your toy ferris wheel with you

IBdaMann claims that Gold is a molecule, and that the last ice age never happened because I was not there to see it. The only conclusion that can be drawn from this is that IBdaMann is clearly not using enough LSD.

According to CDC/Government info, people who were vaccinated are now DYING at a higher rate than non-vaccinated people, which exposes the covid vaccines as the poison that they are, this is now fully confirmed by the terrorist CDC

This place is quieter than the FBI commenting on the chink bank account information on Hunter Xiden's laptop

I LOVE TRUMP BECAUSE HE PISSES OFF ALL THE PEOPLE THAT I CAN'T STAND.

ULTRA MAGA

"Being unwanted, unloved, uncared for, forgotten by everybody, I think that is a much greater hunger, a much greater poverty than the person who has nothing to eat." MOTHER THERESA OF CALCUTTA

So why is helping to hide the murder of an American president patriotic?

It's time to dig up Joseph Mccarthey and show him TikTok, then duck.

Now be honest, was I correct or was I correct? LOL

Edited on 29-12-2023 13:44 |

| 29-12-2023 15:46 |

Swan ★★★★★ ★★★★★

(5725) |

Spongy Iris wrote:

James_ wrote:

Spongy Iris wrote:

Swan wrote:

it gets quieter every time I mention Trumps hidden JFK files that were not found in his home.

Better luck next time, turds.

PS. Happy new year

The word government means mind control.

Sheesh nobody here wants to acknowledge the lie of the Kennedy Space Center.

Crickets.

You need a boyfriend Alan. Go to a gay forum.

I checked out 4 Chan, but I didn't like the lay out and conversations.

4 chan is also one hundred percent under control of the NSA at this point, just like farcebook and x.

But thanks for the tip, but there is no need to learn what I already know

IBdaMann claims that Gold is a molecule, and that the last ice age never happened because I was not there to see it. The only conclusion that can be drawn from this is that IBdaMann is clearly not using enough LSD.

According to CDC/Government info, people who were vaccinated are now DYING at a higher rate than non-vaccinated people, which exposes the covid vaccines as the poison that they are, this is now fully confirmed by the terrorist CDC

This place is quieter than the FBI commenting on the chink bank account information on Hunter Xiden's laptop

I LOVE TRUMP BECAUSE HE PISSES OFF ALL THE PEOPLE THAT I CAN'T STAND.

ULTRA MAGA

"Being unwanted, unloved, uncared for, forgotten by everybody, I think that is a much greater hunger, a much greater poverty than the person who has nothing to eat." MOTHER THERESA OF CALCUTTA

So why is helping to hide the murder of an American president patriotic?

It's time to dig up Joseph Mccarthey and show him TikTok, then duck.

Now be honest, was I correct or was I correct? LOL |

| RE: The Greatest Mind Control Technique29-12-2023 18:18 |

Spongy Iris ★★★★☆ ★★★★☆

(1643) |

Swan wrote:

Spongy Iris wrote:

James_ wrote:

Spongy Iris wrote:

Swan wrote:

it gets quieter every time I mention Trumps hidden JFK files that were not found in his home.

Better luck next time, turds.

PS. Happy new year

The word government means mind control.

Sheesh nobody here wants to acknowledge the lie of the Kennedy Space Center.

Crickets.

You need a boyfriend Alan. Go to a gay forum.

I checked out 4 Chan, but I didn't like the lay out and conversations.

4 chan is also one hundred percent under control of the NSA at this point, just like farcebook and x.

But thanks for the tip, but there is no need to learn what I already know

I like to assume there may be a few normal people who happen to stumble across this forum from time to time, and lurk.

What seems very obvious to anybody is those websites use sex for mind control.

%20(1).png) |

| 29-12-2023 18:23 |

Swan ★★★★★ ★★★★★

(5725) |

Spongy Iris wrote:

Swan wrote:

Spongy Iris wrote:

James_ wrote:

Spongy Iris wrote:

Swan wrote:

it gets quieter every time I mention Trumps hidden JFK files that were not found in his home.

Better luck next time, turds.

PS. Happy new year

The word government means mind control.

Sheesh nobody here wants to acknowledge the lie of the Kennedy Space Center.

Crickets.

You need a boyfriend Alan. Go to a gay forum.

I checked out 4 Chan, but I didn't like the lay out and conversations.

4 chan is also one hundred percent under control of the NSA at this point, just like farcebook and x.

But thanks for the tip, but there is no need to learn what I already know

I like to assume there may be a few normal people who happen to stumble across this forum from time to time, and lurk.

What seems very obvious to anybody is those websites use sex for mind control.

Says the village idiot who did not buy

Market Summary

>

Apple Inc

192.14 USD

+192.03 (174,574.09%)all time

LOL there is currently one user online and that is me and ten guests who can't post online. Which equates to dead

IBdaMann claims that Gold is a molecule, and that the last ice age never happened because I was not there to see it. The only conclusion that can be drawn from this is that IBdaMann is clearly not using enough LSD.

According to CDC/Government info, people who were vaccinated are now DYING at a higher rate than non-vaccinated people, which exposes the covid vaccines as the poison that they are, this is now fully confirmed by the terrorist CDC

This place is quieter than the FBI commenting on the chink bank account information on Hunter Xiden's laptop

I LOVE TRUMP BECAUSE HE PISSES OFF ALL THE PEOPLE THAT I CAN'T STAND.

ULTRA MAGA

"Being unwanted, unloved, uncared for, forgotten by everybody, I think that is a much greater hunger, a much greater poverty than the person who has nothing to eat." MOTHER THERESA OF CALCUTTA

So why is helping to hide the murder of an American president patriotic?

It's time to dig up Joseph Mccarthey and show him TikTok, then duck.

Now be honest, was I correct or was I correct? LOL

Edited on 29-12-2023 18:35 |

| 29-12-2023 18:33 |

Spongy Iris ★★★★☆ ★★★★☆

(1643) |

Swan wrote:

Spongy Iris wrote:

Swan wrote:

Spongy Iris wrote:

James_ wrote:

Spongy Iris wrote:

Swan wrote:

it gets quieter every time I mention Trumps hidden JFK files that were not found in his home.

Better luck next time, turds.

PS. Happy new year

The word government means mind control.

Sheesh nobody here wants to acknowledge the lie of the Kennedy Space Center.

Crickets.

You need a boyfriend Alan. Go to a gay forum.

I checked out 4 Chan, but I didn't like the lay out and conversations.

4 chan is also one hundred percent under control of the NSA at this point, just like farcebook and x.

But thanks for the tip, but there is no need to learn what I already know

I like to assume there may be a few normal people who happen to stumble across this forum from time to time, and lurk.

What seems very obvious to anybody is those websites use sex for mind control.

Says the village idiot who did not buy

Market Summary

>

Apple Inc

192.14 USD

+192.03 (174,574.09%)all time

Bulls###

%20(1).png) |

| 29-12-2023 18:58 |

Swan ★★★★★ ★★★★★

(5725) |

Spongy Iris wrote:

Swan wrote:

Spongy Iris wrote:

Swan wrote:

Spongy Iris wrote:

James_ wrote:

Spongy Iris wrote:

Swan wrote:

it gets quieter every time I mention Trumps hidden JFK files that were not found in his home.

Better luck next time, turds.

PS. Happy new year

The word government means mind control.

Sheesh nobody here wants to acknowledge the lie of the Kennedy Space Center.

Crickets.

You need a boyfriend Alan. Go to a gay forum.

I checked out 4 Chan, but I didn't like the lay out and conversations.

4 chan is also one hundred percent under control of the NSA at this point, just like farcebook and x.

But thanks for the tip, but there is no need to learn what I already know

I like to assume there may be a few normal people who happen to stumble across this forum from time to time, and lurk.

What seems very obvious to anybody is those websites use sex for mind control.

Says the village idiot who did not buy

Market Summary

>

Apple Inc

192.14 USD

+192.03 (174,574.09%)all time

Bulls###

Says the jealous village idiot

Market Summary

>

Apple Inc

192.38 USD

+192.27 (174,791.00%)all time

LOL now there are 12 users online here, which equates to 0.0000000000000000000000000000000000000001 % of all internet usage which means dead

IBdaMann claims that Gold is a molecule, and that the last ice age never happened because I was not there to see it. The only conclusion that can be drawn from this is that IBdaMann is clearly not using enough LSD.

According to CDC/Government info, people who were vaccinated are now DYING at a higher rate than non-vaccinated people, which exposes the covid vaccines as the poison that they are, this is now fully confirmed by the terrorist CDC

This place is quieter than the FBI commenting on the chink bank account information on Hunter Xiden's laptop

I LOVE TRUMP BECAUSE HE PISSES OFF ALL THE PEOPLE THAT I CAN'T STAND.

ULTRA MAGA

"Being unwanted, unloved, uncared for, forgotten by everybody, I think that is a much greater hunger, a much greater poverty than the person who has nothing to eat." MOTHER THERESA OF CALCUTTA

So why is helping to hide the murder of an American president patriotic?

It's time to dig up Joseph Mccarthey and show him TikTok, then duck.

Now be honest, was I correct or was I correct? LOL |

| 29-12-2023 19:51 |

Spongy Iris ★★★★☆ ★★★★☆

(1643) |

Swan wrote:

Says the village idiot who did not buy

Market Summary

>

Apple Inc

192.14 USD

+192.03 (174,574.09%)all time

Bulls###

Says the jealous village idiot

Market Summary

>

Apple Inc

192.38 USD

+192.27 (174,791.00%)all time

LOL now there are 12 users online here, which equates to 0.0000000000000000000000000000000000000001 % of all internet usage which means dead

Wow a jury of 12!

Jealous bears hate AAPL.

AAPL has formed a CUP WITH HANDLE since July 2023.

Per the momentum trader guidelines, once it goes higher than $200, it's time to buy, cuz it will rip the face off the jealous bears on its trajectory to the MOON!

%20(1).png)

Edited on 29-12-2023 19:52 |

| 29-12-2023 20:24 |

Swan ★★★★★ ★★★★★

(5725) |

Spongy Iris wrote:

Swan wrote:

Says the village idiot who did not buy

Market Summary

>

Apple Inc

192.14 USD

+192.03 (174,574.09%)all time

Bulls###

Says the jealous village idiot

Market Summary

>

Apple Inc

192.38 USD

+192.27 (174,791.00%)all time

LOL now there are 12 users online here, which equates to 0.0000000000000000000000000000000000000001 % of all internet usage which means dead

Wow a jury of 12!

Jealous bears hate AAPL.

AAPL has formed a CUP WITH HANDLE since July 2023.

Per the momentum trader guidelines, once it goes higher than $200, it's time to buy, cuz it will rip the face off the jealous bears on its trajectory to the MOON!

Apple (NASDAQ: AAPL) was founded in 1976, and in just four short years it went from a humble start-up with a dream of producing personal computers to a publicly listed company. Today, it's the most valuable listed company in America, with a market capitalization of $2 trillion.

It even has the support of Warren Buffett, who is widely regarded as one of the best investors in history. Apple is the largest single stock holding for his conglomerate, Berkshire Hathaway, which now owns a position worth approximately $115 billion.

But interestingly, Berkshire Hathaway only made its first purchase in 2016, once the company was already a raging success.

Early investors who bought stock in Apple's initial public offering (IPO) 42 years ago would be sitting on life-changing amounts of money today, even with an outlay as small as $1,000.

Unlike Berkshire Hathaway, those investors had to sit through some very rocky periods in Apple's history. But they've certainly been rewarded for their patience, and here's by exactly how much.

Apple has a relentless focus on excellence

Apple is a quintessential consumer products company. Unlike some of its competitors that have branched out into other businesses (think Microsoft, for example), Apple has maintained a laser focus on delivering the highest-quality products and services to its customers.

But when a company puts all of its eggs in one basket, mistakes can be costly, and it hasn't always been smooth sailing at Apple. Late co-founder Steve Jobs was ousted in 1985 after some of the company's new products didn't live up to expectations. Then, after returning in 1997, Jobs said the organization was just 90 days from bankruptcy because it was being crushed in a personal computing industry that had become extremely competitive.

But Apple pulled through, and then truly began to thrive following the 2001 release of the iPod, followed in 2007 by its iPhone, which changed the mobile industry forever. It's estimated that more than 2.2 billion iPhones have been sold since then, and Apple has created more red-hot products on the back of its success like the AirPods wireless headphones and the Apple Watch.

Plus, because the iPhone is now so widely distributed, Apple was able to build a lucrative services business as well. It includes subscription-based essentials like Apple Music, iCloud, and Apple News, and also emerging financial technologies like Apple Pay.

Apple has become a financial juggernaut

In 1980, the year Apple went public, it generated $117 million in sales. By 1990, that figure had grown 50-fold to $5.5 billion. As the below chart shows, the company never looked back.

Apple is also a cash-generating machine. Between fiscal 2016 -- when Berkshire first invested -- and fiscal 2022 (ended Sept. 24, 2022), the company has delivered $460 billion in net income (profit). But Buffett is also known to love companies that return money to shareholders.

Apple began a share buyback program in fiscal 2013 to do just that, and it has since returned more than $550 billion to investors through that vehicle alone.

The value of $1,000 invested in Apple's IPO today

Apple completed its initial public offering on Dec. 12, 1980, at $22 per share. But the company has grown so valuable that management has conducted seven stock splits to reduce its share price, ensuring it remains accessible to smaller investors.

Investing $1,000 in Apple's IPO at $22 per share would've bought you 45 shares. But after adjusting for the stock splits, you'd actually have 10,080 shares now with a cost basis of $0.10 per share.

Since Apple stock trades at $126.36 today, that translates to a return of 126,360%.

In other words, that $1,000 investment in 1980 would be worth more than $1.26 million today! But that's not all, because Apple has paid a dividend in several years since 1987. Assuming you never sold a single share along the way, you would've collected an additional $155,131 in dividend payments!

To this day, you'd still be receiving $9,273 in dividends annually. That's 9 times your initial outlay of $1,000 paid into your pocket every single year. That's the power of long-term investing on full display.

If you've never owned Apple stock before, it's not too late. In fact, since it has declined by 30% from its all-time high, this is a rare opportunity to buy in at a steep discount. Plus, Buffett continued to buy shares as recently as mid-2022, so a purchase today would put you in great company.

IBdaMann claims that Gold is a molecule, and that the last ice age never happened because I was not there to see it. The only conclusion that can be drawn from this is that IBdaMann is clearly not using enough LSD.

According to CDC/Government info, people who were vaccinated are now DYING at a higher rate than non-vaccinated people, which exposes the covid vaccines as the poison that they are, this is now fully confirmed by the terrorist CDC

This place is quieter than the FBI commenting on the chink bank account information on Hunter Xiden's laptop

I LOVE TRUMP BECAUSE HE PISSES OFF ALL THE PEOPLE THAT I CAN'T STAND.

ULTRA MAGA

"Being unwanted, unloved, uncared for, forgotten by everybody, I think that is a much greater hunger, a much greater poverty than the person who has nothing to eat." MOTHER THERESA OF CALCUTTA

So why is helping to hide the murder of an American president patriotic?

It's time to dig up Joseph Mccarthey and show him TikTok, then duck.

Now be honest, was I correct or was I correct? LOL |

| 29-12-2023 21:07 |

Spongy Iris ★★★★☆ ★★★★☆

(1643) |

Swan wrote:

Spongy Iris wrote:

Swan wrote:

Says the village idiot who did not buy

Market Summary

>

Apple Inc

192.14 USD

+192.03 (174,574.09%)all time

Bulls###

Says the jealous village idiot

Market Summary

>

Apple Inc

192.38 USD

+192.27 (174,791.00%)all time

LOL now there are 12 users online here, which equates to 0.0000000000000000000000000000000000000001 % of all internet usage which means dead

Wow a jury of 12!

Jealous bears hate AAPL.

AAPL has formed a CUP WITH HANDLE since July 2023.

Per the momentum trader guidelines, once it goes higher than $200, it's time to buy, cuz it will rip the face off the jealous bears on its trajectory to the MOON!

Apple (NASDAQ: AAPL) was founded in 1976, and in just four short years it went from a humble start-up with a dream of producing personal computers to a publicly listed company. Today, it's the most valuable listed company in America, with a market capitalization of $2 trillion.

It even has the support of Warren Buffett, who is widely regarded as one of the best investors in history. Apple is the largest single stock holding for his conglomerate, Berkshire Hathaway, which now owns a position worth approximately $115 billion.

But interestingly, Berkshire Hathaway only made its first purchase in 2016, once the company was already a raging success.

Early investors who bought stock in Apple's initial public offering (IPO) 42 years ago would be sitting on life-changing amounts of money today, even with an outlay as small as $1,000.

Unlike Berkshire Hathaway, those investors had to sit through some very rocky periods in Apple's history. But they've certainly been rewarded for their patience, and here's by exactly how much.

Apple has a relentless focus on excellence

Apple is a quintessential consumer products company. Unlike some of its competitors that have branched out into other businesses (think Microsoft, for example), Apple has maintained a laser focus on delivering the highest-quality products and services to its customers.

But when a company puts all of its eggs in one basket, mistakes can be costly, and it hasn't always been smooth sailing at Apple. Late co-founder Steve Jobs was ousted in 1985 after some of the company's new products didn't live up to expectations. Then, after returning in 1997, Jobs said the organization was just 90 days from bankruptcy because it was being crushed in a personal computing industry that had become extremely competitive.

But Apple pulled through, and then truly began to thrive following the 2001 release of the iPod, followed in 2007 by its iPhone, which changed the mobile industry forever. It's estimated that more than 2.2 billion iPhones have been sold since then, and Apple has created more red-hot products on the back of its success like the AirPods wireless headphones and the Apple Watch.

Plus, because the iPhone is now so widely distributed, Apple was able to build a lucrative services business as well. It includes subscription-based essentials like Apple Music, iCloud, and Apple News, and also emerging financial technologies like Apple Pay.

Apple has become a financial juggernaut

In 1980, the year Apple went public, it generated $117 million in sales. By 1990, that figure had grown 50-fold to $5.5 billion. As the below chart shows, the company never looked back.

Apple is also a cash-generating machine. Between fiscal 2016 -- when Berkshire first invested -- and fiscal 2022 (ended Sept. 24, 2022), the company has delivered $460 billion in net income (profit). But Buffett is also known to love companies that return money to shareholders.

Apple began a share buyback program in fiscal 2013 to do just that, and it has since returned more than $550 billion to investors through that vehicle alone.

The value of $1,000 invested in Apple's IPO today

Apple completed its initial public offering on Dec. 12, 1980, at $22 per share. But the company has grown so valuable that management has conducted seven stock splits to reduce its share price, ensuring it remains accessible to smaller investors.

Investing $1,000 in Apple's IPO at $22 per share would've bought you 45 shares. But after adjusting for the stock splits, you'd actually have 10,080 shares now with a cost basis of $0.10 per share.

Since Apple stock trades at $126.36 today, that translates to a return of 126,360%.

In other words, that $1,000 investment in 1980 would be worth more than $1.26 million today! But that's not all, because Apple has paid a dividend in several years since 1987. Assuming you never sold a single share along the way, you would've collected an additional $155,131 in dividend payments!

To this day, you'd still be receiving $9,273 in dividends annually. That's 9 times your initial outlay of $1,000 paid into your pocket every single year. That's the power of long-term investing on full display.

If you've never owned Apple stock before, it's not too late. In fact, since it has declined by 30% from its all-time high, this is a rare opportunity to buy in at a steep discount. Plus, Buffett continued to buy shares as recently as mid-2022, so a purchase today would put you in great company.

Well it has a increased from being worth $2 trillion to being worth $3 trillion since that article was wrote.

Anyway like I said, once the momentum takes it higher than $200 per share, should be worth $6 trillion in short order.

Phoque the bears.

There's always more whales to bid up the price.

%20(1).png) |

|

| 29-12-2023 21:27 |

Swan ★★★★★ ★★★★★

(5725) |

Spongy Iris wrote:

Swan wrote:

Spongy Iris wrote:

Swan wrote:

Says the village idiot who did not buy

Market Summary

>

Apple Inc

192.14 USD

+192.03 (174,574.09%)all time

Bulls###

Says the jealous village idiot

Market Summary

>

Apple Inc

192.38 USD

+192.27 (174,791.00%)all time

LOL now there are 12 users online here, which equates to 0.0000000000000000000000000000000000000001 % of all internet usage which means dead

Wow a jury of 12!

Jealous bears hate AAPL.

AAPL has formed a CUP WITH HANDLE since July 2023.

Per the momentum trader guidelines, once it goes higher than $200, it's time to buy, cuz it will rip the face off the jealous bears on its trajectory to the MOON!

Apple (NASDAQ: AAPL) was founded in 1976, and in just four short years it went from a humble start-up with a dream of producing personal computers to a publicly listed company. Today, it's the most valuable listed company in America, with a market capitalization of $2 trillion.

It even has the support of Warren Buffett, who is widely regarded as one of the best investors in history. Apple is the largest single stock holding for his conglomerate, Berkshire Hathaway, which now owns a position worth approximately $115 billion.

But interestingly, Berkshire Hathaway only made its first purchase in 2016, once the company was already a raging success.

Early investors who bought stock in Apple's initial public offering (IPO) 42 years ago would be sitting on life-changing amounts of money today, even with an outlay as small as $1,000.

Unlike Berkshire Hathaway, those investors had to sit through some very rocky periods in Apple's history. But they've certainly been rewarded for their patience, and here's by exactly how much.

Apple has a relentless focus on excellence

Apple is a quintessential consumer products company. Unlike some of its competitors that have branched out into other businesses (think Microsoft, for example), Apple has maintained a laser focus on delivering the highest-quality products and services to its customers.

But when a company puts all of its eggs in one basket, mistakes can be costly, and it hasn't always been smooth sailing at Apple. Late co-founder Steve Jobs was ousted in 1985 after some of the company's new products didn't live up to expectations. Then, after returning in 1997, Jobs said the organization was just 90 days from bankruptcy because it was being crushed in a personal computing industry that had become extremely competitive.

But Apple pulled through, and then truly began to thrive following the 2001 release of the iPod, followed in 2007 by its iPhone, which changed the mobile industry forever. It's estimated that more than 2.2 billion iPhones have been sold since then, and Apple has created more red-hot products on the back of its success like the AirPods wireless headphones and the Apple Watch.

Plus, because the iPhone is now so widely distributed, Apple was able to build a lucrative services business as well. It includes subscription-based essentials like Apple Music, iCloud, and Apple News, and also emerging financial technologies like Apple Pay.

Apple has become a financial juggernaut

In 1980, the year Apple went public, it generated $117 million in sales. By 1990, that figure had grown 50-fold to $5.5 billion. As the below chart shows, the company never looked back.

Apple is also a cash-generating machine. Between fiscal 2016 -- when Berkshire first invested -- and fiscal 2022 (ended Sept. 24, 2022), the company has delivered $460 billion in net income (profit). But Buffett is also known to love companies that return money to shareholders.

Apple began a share buyback program in fiscal 2013 to do just that, and it has since returned more than $550 billion to investors through that vehicle alone.

The value of $1,000 invested in Apple's IPO today

Apple completed its initial public offering on Dec. 12, 1980, at $22 per share. But the company has grown so valuable that management has conducted seven stock splits to reduce its share price, ensuring it remains accessible to smaller investors.

Investing $1,000 in Apple's IPO at $22 per share would've bought you 45 shares. But after adjusting for the stock splits, you'd actually have 10,080 shares now with a cost basis of $0.10 per share.

Since Apple stock trades at $126.36 today, that translates to a return of 126,360%.

In other words, that $1,000 investment in 1980 would be worth more than $1.26 million today! But that's not all, because Apple has paid a dividend in several years since 1987. Assuming you never sold a single share along the way, you would've collected an additional $155,131 in dividend payments!

To this day, you'd still be receiving $9,273 in dividends annually. That's 9 times your initial outlay of $1,000 paid into your pocket every single year. That's the power of long-term investing on full display.

If you've never owned Apple stock before, it's not too late. In fact, since it has declined by 30% from its all-time high, this is a rare opportunity to buy in at a steep discount. Plus, Buffett continued to buy shares as recently as mid-2022, so a purchase today would put you in great company.

Well it has a increased from being worth $2 trillion to being worth $3 trillion since that article was wrote.

Anyway like I said, once the momentum takes it higher than $200 per share, should be worth $6 trillion in short order.

Phoque the bears.

There's always more whales to bid up the price.

The moron strikes again as with 15,599,434,000 outstanding shares of Apple existing when the stock hits 200 dollars per share the new market cap is $3,119,886,800,000.00 so check your math little girl.

IBdaMann claims that Gold is a molecule, and that the last ice age never happened because I was not there to see it. The only conclusion that can be drawn from this is that IBdaMann is clearly not using enough LSD.

According to CDC/Government info, people who were vaccinated are now DYING at a higher rate than non-vaccinated people, which exposes the covid vaccines as the poison that they are, this is now fully confirmed by the terrorist CDC

This place is quieter than the FBI commenting on the chink bank account information on Hunter Xiden's laptop

I LOVE TRUMP BECAUSE HE PISSES OFF ALL THE PEOPLE THAT I CAN'T STAND.

ULTRA MAGA

"Being unwanted, unloved, uncared for, forgotten by everybody, I think that is a much greater hunger, a much greater poverty than the person who has nothing to eat." MOTHER THERESA OF CALCUTTA

So why is helping to hide the murder of an American president patriotic?

It's time to dig up Joseph Mccarthey and show him TikTok, then duck.

Now be honest, was I correct or was I correct? LOL |

| 29-12-2023 22:31 |

Spongy Iris ★★★★☆ ★★★★☆

(1643) |

Swan wrote:

Spongy Iris wrote:

Swan wrote:

Spongy Iris wrote:

Swan wrote:

Says the village idiot who did not buy

Market Summary

>

Apple Inc

192.14 USD

+192.03 (174,574.09%)all time

Bulls###

Says the jealous village idiot

Market Summary

>

Apple Inc

192.38 USD

+192.27 (174,791.00%)all time

LOL now there are 12 users online here, which equates to 0.0000000000000000000000000000000000000001 % of all internet usage which means dead

Wow a jury of 12!

Jealous bears hate AAPL.

AAPL has formed a CUP WITH HANDLE since July 2023.

Per the momentum trader guidelines, once it goes higher than $200, it's time to buy, cuz it will rip the face off the jealous bears on its trajectory to the MOON!

Apple (NASDAQ: AAPL) was founded in 1976, and in just four short years it went from a humble start-up with a dream of producing personal computers to a publicly listed company. Today, it's the most valuable listed company in America, with a market capitalization of $2 trillion.

It even has the support of Warren Buffett, who is widely regarded as one of the best investors in history. Apple is the largest single stock holding for his conglomerate, Berkshire Hathaway, which now owns a position worth approximately $115 billion.

But interestingly, Berkshire Hathaway only made its first purchase in 2016, once the company was already a raging success.

Early investors who bought stock in Apple's initial public offering (IPO) 42 years ago would be sitting on life-changing amounts of money today, even with an outlay as small as $1,000.

Unlike Berkshire Hathaway, those investors had to sit through some very rocky periods in Apple's history. But they've certainly been rewarded for their patience, and here's by exactly how much.

Apple has a relentless focus on excellence

Apple is a quintessential consumer products company. Unlike some of its competitors that have branched out into other businesses (think Microsoft, for example), Apple has maintained a laser focus on delivering the highest-quality products and services to its customers.

But when a company puts all of its eggs in one basket, mistakes can be costly, and it hasn't always been smooth sailing at Apple. Late co-founder Steve Jobs was ousted in 1985 after some of the company's new products didn't live up to expectations. Then, after returning in 1997, Jobs said the organization was just 90 days from bankruptcy because it was being crushed in a personal computing industry that had become extremely competitive.

But Apple pulled through, and then truly began to thrive following the 2001 release of the iPod, followed in 2007 by its iPhone, which changed the mobile industry forever. It's estimated that more than 2.2 billion iPhones have been sold since then, and Apple has created more red-hot products on the back of its success like the AirPods wireless headphones and the Apple Watch.

Plus, because the iPhone is now so widely distributed, Apple was able to build a lucrative services business as well. It includes subscription-based essentials like Apple Music, iCloud, and Apple News, and also emerging financial technologies like Apple Pay.

Apple has become a financial juggernaut

In 1980, the year Apple went public, it generated $117 million in sales. By 1990, that figure had grown 50-fold to $5.5 billion. As the below chart shows, the company never looked back.

Apple is also a cash-generating machine. Between fiscal 2016 -- when Berkshire first invested -- and fiscal 2022 (ended Sept. 24, 2022), the company has delivered $460 billion in net income (profit). But Buffett is also known to love companies that return money to shareholders.

Apple began a share buyback program in fiscal 2013 to do just that, and it has since returned more than $550 billion to investors through that vehicle alone.

The value of $1,000 invested in Apple's IPO today

Apple completed its initial public offering on Dec. 12, 1980, at $22 per share. But the company has grown so valuable that management has conducted seven stock splits to reduce its share price, ensuring it remains accessible to smaller investors.

Investing $1,000 in Apple's IPO at $22 per share would've bought you 45 shares. But after adjusting for the stock splits, you'd actually have 10,080 shares now with a cost basis of $0.10 per share.

Since Apple stock trades at $126.36 today, that translates to a return of 126,360%.

In other words, that $1,000 investment in 1980 would be worth more than $1.26 million today! But that's not all, because Apple has paid a dividend in several years since 1987. Assuming you never sold a single share along the way, you would've collected an additional $155,131 in dividend payments!

To this day, you'd still be receiving $9,273 in dividends annually. That's 9 times your initial outlay of $1,000 paid into your pocket every single year. That's the power of long-term investing on full display.

If you've never owned Apple stock before, it's not too late. In fact, since it has declined by 30% from its all-time high, this is a rare opportunity to buy in at a steep discount. Plus, Buffett continued to buy shares as recently as mid-2022, so a purchase today would put you in great company.

Well it has a increased from being worth $2 trillion to being worth $3 trillion since that article was wrote.

Anyway like I said, once the momentum takes it higher than $200 per share, should be worth $6 trillion in short order.

Phoque the bears.

There's always more whales to bid up the price.

The moron strikes again as with 15,599,434,000 outstanding shares of Apple existing when the stock hits 200 dollars per share the new market cap is $3,119,886,800,000.00 so check your math little girl.

Says the math whiz splitting hairs.

With today's price of $192, the market cap is $2.995 trillion. If it closes at $193, it will be $3.011 trillion.

But the main point that nobody will prove wrong, is once the price rises above $200, the momentum will soon carry it to a market cap of $6 trillion by 2025.

If the price can go from $40 to $200 in the past 5 years, surely it can double in 1 more year!

That's just basic Wall Street wisdom which says past returns must equal future returns, and then some.

%20(1).png) |

| 29-12-2023 23:11 |

Swan ★★★★★ ★★★★★

(5725) |

Spongy Iris wrote:

Swan wrote:

Spongy Iris wrote:

Swan wrote:

Spongy Iris wrote:

Swan wrote:

Says the village idiot who did not buy

Market Summary

>

Apple Inc

192.14 USD

+192.03 (174,574.09%)all time

Bulls###

Says the jealous village idiot

Market Summary

>

Apple Inc

192.38 USD

+192.27 (174,791.00%)all time

LOL now there are 12 users online here, which equates to 0.0000000000000000000000000000000000000001 % of all internet usage which means dead

Wow a jury of 12!

Jealous bears hate AAPL.

AAPL has formed a CUP WITH HANDLE since July 2023.

Per the momentum trader guidelines, once it goes higher than $200, it's time to buy, cuz it will rip the face off the jealous bears on its trajectory to the MOON!

Apple (NASDAQ: AAPL) was founded in 1976, and in just four short years it went from a humble start-up with a dream of producing personal computers to a publicly listed company. Today, it's the most valuable listed company in America, with a market capitalization of $2 trillion.

It even has the support of Warren Buffett, who is widely regarded as one of the best investors in history. Apple is the largest single stock holding for his conglomerate, Berkshire Hathaway, which now owns a position worth approximately $115 billion.

But interestingly, Berkshire Hathaway only made its first purchase in 2016, once the company was already a raging success.

Early investors who bought stock in Apple's initial public offering (IPO) 42 years ago would be sitting on life-changing amounts of money today, even with an outlay as small as $1,000.

Unlike Berkshire Hathaway, those investors had to sit through some very rocky periods in Apple's history. But they've certainly been rewarded for their patience, and here's by exactly how much.

Apple has a relentless focus on excellence

Apple is a quintessential consumer products company. Unlike some of its competitors that have branched out into other businesses (think Microsoft, for example), Apple has maintained a laser focus on delivering the highest-quality products and services to its customers.

But when a company puts all of its eggs in one basket, mistakes can be costly, and it hasn't always been smooth sailing at Apple. Late co-founder Steve Jobs was ousted in 1985 after some of the company's new products didn't live up to expectations. Then, after returning in 1997, Jobs said the organization was just 90 days from bankruptcy because it was being crushed in a personal computing industry that had become extremely competitive.

But Apple pulled through, and then truly began to thrive following the 2001 release of the iPod, followed in 2007 by its iPhone, which changed the mobile industry forever. It's estimated that more than 2.2 billion iPhones have been sold since then, and Apple has created more red-hot products on the back of its success like the AirPods wireless headphones and the Apple Watch.

Plus, because the iPhone is now so widely distributed, Apple was able to build a lucrative services business as well. It includes subscription-based essentials like Apple Music, iCloud, and Apple News, and also emerging financial technologies like Apple Pay.

Apple has become a financial juggernaut

In 1980, the year Apple went public, it generated $117 million in sales. By 1990, that figure had grown 50-fold to $5.5 billion. As the below chart shows, the company never looked back.

Apple is also a cash-generating machine. Between fiscal 2016 -- when Berkshire first invested -- and fiscal 2022 (ended Sept. 24, 2022), the company has delivered $460 billion in net income (profit). But Buffett is also known to love companies that return money to shareholders.

Apple began a share buyback program in fiscal 2013 to do just that, and it has since returned more than $550 billion to investors through that vehicle alone.

The value of $1,000 invested in Apple's IPO today

Apple completed its initial public offering on Dec. 12, 1980, at $22 per share. But the company has grown so valuable that management has conducted seven stock splits to reduce its share price, ensuring it remains accessible to smaller investors.

Investing $1,000 in Apple's IPO at $22 per share would've bought you 45 shares. But after adjusting for the stock splits, you'd actually have 10,080 shares now with a cost basis of $0.10 per share.

Since Apple stock trades at $126.36 today, that translates to a return of 126,360%.

In other words, that $1,000 investment in 1980 would be worth more than $1.26 million today! But that's not all, because Apple has paid a dividend in several years since 1987. Assuming you never sold a single share along the way, you would've collected an additional $155,131 in dividend payments!

To this day, you'd still be receiving $9,273 in dividends annually. That's 9 times your initial outlay of $1,000 paid into your pocket every single year. That's the power of long-term investing on full display.

If you've never owned Apple stock before, it's not too late. In fact, since it has declined by 30% from its all-time high, this is a rare opportunity to buy in at a steep discount. Plus, Buffett continued to buy shares as recently as mid-2022, so a purchase today would put you in great company.

Well it has a increased from being worth $2 trillion to being worth $3 trillion since that article was wrote.

Anyway like I said, once the momentum takes it higher than $200 per share, should be worth $6 trillion in short order.

Phoque the bears.

There's always more whales to bid up the price.

The moron strikes again as with 15,599,434,000 outstanding shares of Apple existing when the stock hits 200 dollars per share the new market cap is $3,119,886,800,000.00 so check your math little girl.

Says the math whiz splitting hairs.

With today's price of $192, the market cap is $2.995 trillion. If it closes at $193, it will be $3.011 trillion.

But the main point that nobody will prove wrong, is once the price rises above $200, the momentum will soon carry it to a market cap of $6 trillion by 2025.

If the price can go from $40 to $200 in the past 5 years, surely it can double in 1 more year!

That's just basic Wall Street wisdom which says past returns must equal future returns, and then some.

Apple will not double in 24 or 25, wanna make a friendly $100,000.00 wager, or os the little girl scared?

IBdaMann claims that Gold is a molecule, and that the last ice age never happened because I was not there to see it. The only conclusion that can be drawn from this is that IBdaMann is clearly not using enough LSD.

According to CDC/Government info, people who were vaccinated are now DYING at a higher rate than non-vaccinated people, which exposes the covid vaccines as the poison that they are, this is now fully confirmed by the terrorist CDC

This place is quieter than the FBI commenting on the chink bank account information on Hunter Xiden's laptop

I LOVE TRUMP BECAUSE HE PISSES OFF ALL THE PEOPLE THAT I CAN'T STAND.

ULTRA MAGA

"Being unwanted, unloved, uncared for, forgotten by everybody, I think that is a much greater hunger, a much greater poverty than the person who has nothing to eat." MOTHER THERESA OF CALCUTTA

So why is helping to hide the murder of an American president patriotic?

It's time to dig up Joseph Mccarthey and show him TikTok, then duck.

Now be honest, was I correct or was I correct? LOL |

| 30-12-2023 00:31 |

Spongy Iris ★★★★☆ ★★★★☆

(1643) |

Swan wrote:

Spongy Iris wrote:

Swan wrote:

Spongy Iris wrote:

Swan wrote:

Spongy Iris wrote:

Swan wrote:

Says the village idiot who did not buy

Market Summary

>

Apple Inc

192.14 USD

+192.03 (174,574.09%)all time

Bulls###

Says the jealous village idiot

Market Summary

>

Apple Inc

192.38 USD

+192.27 (174,791.00%)all time

LOL now there are 12 users online here, which equates to 0.0000000000000000000000000000000000000001 % of all internet usage which means dead

Wow a jury of 12!

Jealous bears hate AAPL.

AAPL has formed a CUP WITH HANDLE since July 2023.

Per the momentum trader guidelines, once it goes higher than $200, it's time to buy, cuz it will rip the face off the jealous bears on its trajectory to the MOON!

Apple (NASDAQ: AAPL) was founded in 1976, and in just four short years it went from a humble start-up with a dream of producing personal computers to a publicly listed company. Today, it's the most valuable listed company in America, with a market capitalization of $2 trillion.

It even has the support of Warren Buffett, who is widely regarded as one of the best investors in history. Apple is the largest single stock holding for his conglomerate, Berkshire Hathaway, which now owns a position worth approximately $115 billion.

But interestingly, Berkshire Hathaway only made its first purchase in 2016, once the company was already a raging success.

Early investors who bought stock in Apple's initial public offering (IPO) 42 years ago would be sitting on life-changing amounts of money today, even with an outlay as small as $1,000.

Unlike Berkshire Hathaway, those investors had to sit through some very rocky periods in Apple's history. But they've certainly been rewarded for their patience, and here's by exactly how much.

Apple has a relentless focus on excellence

Apple is a quintessential consumer products company. Unlike some of its competitors that have branched out into other businesses (think Microsoft, for example), Apple has maintained a laser focus on delivering the highest-quality products and services to its customers.

But when a company puts all of its eggs in one basket, mistakes can be costly, and it hasn't always been smooth sailing at Apple. Late co-founder Steve Jobs was ousted in 1985 after some of the company's new products didn't live up to expectations. Then, after returning in 1997, Jobs said the organization was just 90 days from bankruptcy because it was being crushed in a personal computing industry that had become extremely competitive.

But Apple pulled through, and then truly began to thrive following the 2001 release of the iPod, followed in 2007 by its iPhone, which changed the mobile industry forever. It's estimated that more than 2.2 billion iPhones have been sold since then, and Apple has created more red-hot products on the back of its success like the AirPods wireless headphones and the Apple Watch.

Plus, because the iPhone is now so widely distributed, Apple was able to build a lucrative services business as well. It includes subscription-based essentials like Apple Music, iCloud, and Apple News, and also emerging financial technologies like Apple Pay.

Apple has become a financial juggernaut

In 1980, the year Apple went public, it generated $117 million in sales. By 1990, that figure had grown 50-fold to $5.5 billion. As the below chart shows, the company never looked back.

Apple is also a cash-generating machine. Between fiscal 2016 -- when Berkshire first invested -- and fiscal 2022 (ended Sept. 24, 2022), the company has delivered $460 billion in net income (profit). But Buffett is also known to love companies that return money to shareholders.

Apple began a share buyback program in fiscal 2013 to do just that, and it has since returned more than $550 billion to investors through that vehicle alone.

The value of $1,000 invested in Apple's IPO today

Apple completed its initial public offering on Dec. 12, 1980, at $22 per share. But the company has grown so valuable that management has conducted seven stock splits to reduce its share price, ensuring it remains accessible to smaller investors.

Investing $1,000 in Apple's IPO at $22 per share would've bought you 45 shares. But after adjusting for the stock splits, you'd actually have 10,080 shares now with a cost basis of $0.10 per share.

Since Apple stock trades at $126.36 today, that translates to a return of 126,360%.

In other words, that $1,000 investment in 1980 would be worth more than $1.26 million today! But that's not all, because Apple has paid a dividend in several years since 1987. Assuming you never sold a single share along the way, you would've collected an additional $155,131 in dividend payments!

To this day, you'd still be receiving $9,273 in dividends annually. That's 9 times your initial outlay of $1,000 paid into your pocket every single year. That's the power of long-term investing on full display.

If you've never owned Apple stock before, it's not too late. In fact, since it has declined by 30% from its all-time high, this is a rare opportunity to buy in at a steep discount. Plus, Buffett continued to buy shares as recently as mid-2022, so a purchase today would put you in great company.

Well it has a increased from being worth $2 trillion to being worth $3 trillion since that article was wrote.

Anyway like I said, once the momentum takes it higher than $200 per share, should be worth $6 trillion in short order.

Phoque the bears.

There's always more whales to bid up the price.

The moron strikes again as with 15,599,434,000 outstanding shares of Apple existing when the stock hits 200 dollars per share the new market cap is $3,119,886,800,000.00 so check your math little girl.

Says the math whiz splitting hairs.

With today's price of $192, the market cap is $2.995 trillion. If it closes at $193, it will be $3.011 trillion.

But the main point that nobody will prove wrong, is once the price rises above $200, the momentum will soon carry it to a market cap of $6 trillion by 2025.

If the price can go from $40 to $200 in the past 5 years, surely it can double in 1 more year!

That's just basic Wall Street wisdom which says past returns must equal future returns, and then some.

Apple will not double in 24 or 25, wanna make a friendly $100,000.00 wager, or os the little girl scared?

Obviously not, cuz I'm really a poor jealous bear being sarcastic as I dig through camper's trash praying for my next month's meal ticket.

%20(1).png) |

| 30-12-2023 02:18 |

Swan ★★★★★ ★★★★★

(5725) |

Spongy Iris wrote:

Swan wrote:

Spongy Iris wrote:

Swan wrote:

Spongy Iris wrote:

Swan wrote:

Spongy Iris wrote:

Swan wrote:

Says the village idiot who did not buy

Market Summary

>

Apple Inc

192.14 USD

+192.03 (174,574.09%)all time

Bulls###

Says the jealous village idiot

Market Summary

>

Apple Inc

192.38 USD

+192.27 (174,791.00%)all time

LOL now there are 12 users online here, which equates to 0.0000000000000000000000000000000000000001 % of all internet usage which means dead

Wow a jury of 12!

Jealous bears hate AAPL.

AAPL has formed a CUP WITH HANDLE since July 2023.

Per the momentum trader guidelines, once it goes higher than $200, it's time to buy, cuz it will rip the face off the jealous bears on its trajectory to the MOON!

Apple (NASDAQ: AAPL) was founded in 1976, and in just four short years it went from a humble start-up with a dream of producing personal computers to a publicly listed company. Today, it's the most valuable listed company in America, with a market capitalization of $2 trillion.

It even has the support of Warren Buffett, who is widely regarded as one of the best investors in history. Apple is the largest single stock holding for his conglomerate, Berkshire Hathaway, which now owns a position worth approximately $115 billion.

But interestingly, Berkshire Hathaway only made its first purchase in 2016, once the company was already a raging success.

Early investors who bought stock in Apple's initial public offering (IPO) 42 years ago would be sitting on life-changing amounts of money today, even with an outlay as small as $1,000.

Unlike Berkshire Hathaway, those investors had to sit through some very rocky periods in Apple's history. But they've certainly been rewarded for their patience, and here's by exactly how much.

Apple has a relentless focus on excellence

Apple is a quintessential consumer products company. Unlike some of its competitors that have branched out into other businesses (think Microsoft, for example), Apple has maintained a laser focus on delivering the highest-quality products and services to its customers.

But when a company puts all of its eggs in one basket, mistakes can be costly, and it hasn't always been smooth sailing at Apple. Late co-founder Steve Jobs was ousted in 1985 after some of the company's new products didn't live up to expectations. Then, after returning in 1997, Jobs said the organization was just 90 days from bankruptcy because it was being crushed in a personal computing industry that had become extremely competitive.

But Apple pulled through, and then truly began to thrive following the 2001 release of the iPod, followed in 2007 by its iPhone, which changed the mobile industry forever. It's estimated that more than 2.2 billion iPhones have been sold since then, and Apple has created more red-hot products on the back of its success like the AirPods wireless headphones and the Apple Watch.

Plus, because the iPhone is now so widely distributed, Apple was able to build a lucrative services business as well. It includes subscription-based essentials like Apple Music, iCloud, and Apple News, and also emerging financial technologies like Apple Pay.

Apple has become a financial juggernaut

In 1980, the year Apple went public, it generated $117 million in sales. By 1990, that figure had grown 50-fold to $5.5 billion. As the below chart shows, the company never looked back.

Apple is also a cash-generating machine. Between fiscal 2016 -- when Berkshire first invested -- and fiscal 2022 (ended Sept. 24, 2022), the company has delivered $460 billion in net income (profit). But Buffett is also known to love companies that return money to shareholders.

Apple began a share buyback program in fiscal 2013 to do just that, and it has since returned more than $550 billion to investors through that vehicle alone.

The value of $1,000 invested in Apple's IPO today

Apple completed its initial public offering on Dec. 12, 1980, at $22 per share. But the company has grown so valuable that management has conducted seven stock splits to reduce its share price, ensuring it remains accessible to smaller investors.

Investing $1,000 in Apple's IPO at $22 per share would've bought you 45 shares. But after adjusting for the stock splits, you'd actually have 10,080 shares now with a cost basis of $0.10 per share.

Since Apple stock trades at $126.36 today, that translates to a return of 126,360%.

In other words, that $1,000 investment in 1980 would be worth more than $1.26 million today! But that's not all, because Apple has paid a dividend in several years since 1987. Assuming you never sold a single share along the way, you would've collected an additional $155,131 in dividend payments!

To this day, you'd still be receiving $9,273 in dividends annually. That's 9 times your initial outlay of $1,000 paid into your pocket every single year. That's the power of long-term investing on full display.

If you've never owned Apple stock before, it's not too late. In fact, since it has declined by 30% from its all-time high, this is a rare opportunity to buy in at a steep discount. Plus, Buffett continued to buy shares as recently as mid-2022, so a purchase today would put you in great company.

Well it has a increased from being worth $2 trillion to being worth $3 trillion since that article was wrote.

Anyway like I said, once the momentum takes it higher than $200 per share, should be worth $6 trillion in short order.

Phoque the bears.

There's always more whales to bid up the price.

The moron strikes again as with 15,599,434,000 outstanding shares of Apple existing when the stock hits 200 dollars per share the new market cap is $3,119,886,800,000.00 so check your math little girl.

Says the math whiz splitting hairs.

With today's price of $192, the market cap is $2.995 trillion. If it closes at $193, it will be $3.011 trillion.

But the main point that nobody will prove wrong, is once the price rises above $200, the momentum will soon carry it to a market cap of $6 trillion by 2025.

If the price can go from $40 to $200 in the past 5 years, surely it can double in 1 more year!

That's just basic Wall Street wisdom which says past returns must equal future returns, and then some.

Apple will not double in 24 or 25, wanna make a friendly $100,000.00 wager, or os the little girl scared?

Obviously not, cuz I'm really a poor jealous bear being sarcastic as I dig through camper's trash praying for my next month's meal ticket.

All talk.

For meals you can put out some cat traps

IBdaMann claims that Gold is a molecule, and that the last ice age never happened because I was not there to see it. The only conclusion that can be drawn from this is that IBdaMann is clearly not using enough LSD.

According to CDC/Government info, people who were vaccinated are now DYING at a higher rate than non-vaccinated people, which exposes the covid vaccines as the poison that they are, this is now fully confirmed by the terrorist CDC

This place is quieter than the FBI commenting on the chink bank account information on Hunter Xiden's laptop

I LOVE TRUMP BECAUSE HE PISSES OFF ALL THE PEOPLE THAT I CAN'T STAND.

ULTRA MAGA

"Being unwanted, unloved, uncared for, forgotten by everybody, I think that is a much greater hunger, a much greater poverty than the person who has nothing to eat." MOTHER THERESA OF CALCUTTA

So why is helping to hide the murder of an American president patriotic?

It's time to dig up Joseph Mccarthey and show him TikTok, then duck.

Now be honest, was I correct or was I correct? LOL |

%20(1).png)

%20(1).png)

%20(1).png)

%20(1).png)

%20(1).png)

%20(1).png)

%20(1).png)

%20(1).png)