Is Mitch McConnell Being Played?

| 18-12-2020 06:17 | |

| James___★★★★★ (5513) |

IBdaMann wrote:James___ wrote: p.s., margins are paying a % of what you are buying. You just said what I said. When margins are called, the money does need to be in your account. |

| 18-12-2020 06:34 | |

| IBdaMann (14389) |

James___ wrote:IBdaMann wrote:You just said what I said. When margins are called, the money does need to be in your account.James___ wrote: p.s., margins are paying a % of what you are buying.Nope. You are thinking of commissions. Au contraire mon frère, you specifically referred to margins as something that one pays. Margins are not paid; they are held in your account. Don't be afraid to come to me with the hard stuff (vodka is fine). . I don't think i can [define it]. I just kind of get a feel for the phrase. - keepit A Spaghetti strainer with the faucet running, retains water- tmiddles Clouds don't trap heat. Clouds block cold. - Spongy Iris Printing dollars to pay debt doesn't increase the number of dollars. - keepit If Venus were a black body it would have a much much lower temperature than what we found there.- tmiddles Ah the "Valid Data" myth of ITN/IBD. - tmiddles Ceist - I couldn't agree with you more. But when money and religion are involved, and there are people who value them above all else, then the lies begin. - trafn You are completely misunderstanding their use of the word "accumulation"! - Climate Scientist. The Stefan-Boltzman equation doesn't come up with the correct temperature if greenhouse gases are not considered - Hank :*sigh* Not the "raw data" crap. - Leafsdude IB STILL hasn't explained what Planck's Law means. Just more hand waving that it applies to everything and more asserting that the greenhouse effect 'violates' it.- Ceist |

| 18-12-2020 07:36 | |

| IBdaMann (14389) |

Spongy Iris, let's talk investing ...Spongy Iris wrote:It sure seems, stocks are entirely speculative. Stock is ownership of a business. Are you under the impression that the business so owned is merely speculative, or do you believe that the business' performance is a function of management decisions and market conditions? If you roll dice to determine which stocks you buy then yes, the performance of your portfolio will be as speculative as your guess as to which values you roll with the dice. If instead you do your homework and buy stocks based on your research of management style and market projections then your stock purchase will not be speculative but rather will be true investments. Spongy Iris wrote:A crock of bull, this talk about sharing in a company's profit. Stock shares are legal entitlement to shares of profit as well as ownership shares in the business itself. Spongy Iris wrote:The closest thing to what you are talking about is dividends. It will take a very long time to recoup your investment solely waiting for dividends to pay out. No prudent risk manager would wait that long. This needs to be unpacked. 1) Shares receive of all distributions just as "the owner" would because shares are ownership. 2) The time to recoup the investment is calculated several ways and is why we have a P/E metric. 3) Risk managers get no say on what "break even point" the owners are willing to incur. They simply advise the owners/investors of the risk surrounding any given investment. 4) Every day big money is invested with "break even points" years and even decades in the future. Every day. Spongy Iris wrote:Amazon is obviously never going to generate $1.62 trillion in savings. This statement makes no sense. Amazon will obviously generate $1.62 trillion in revenue and then continue earning revenue ... but obviously Amazon isn't going to maintain it all in "petty cash." Where were you trying to go with this? Spongy Iris wrote:They have been losing money most of the time. Amazon makes money hand-over-fist. Whoever is doing your thinking for you is providing you with bogus misinformation. Jeff Bezos wouldn't be the richest person in human history if all he did was lose money. Spongy Iris wrote:Share in the ownership of a company is a meaningless scam phrase of buzzword proportion. You are in heavy denial. I hope you are able to work it out. Spongy Iris wrote:But ya seems like there is always a greater fool to pay a higher price to buy a stock than you did. It's the most genius scam ever. Nope. Every day people lose money on stocks because the price went down and they people couldn't find anyone to pay more than they themselves paid. Every day. Don't be afraid to come to me with the hard stuff. . Attached image:  |

| 18-12-2020 10:13 | |

| HarveyH55 (5196) |

People don't really lose money on their stocks, unless they sell them for less than what they paid. The market value of pretty much all stocks change throughout the day. Some can drop way below what you paid for a while, then jump right back up into gaining value. Depends on the nature of the company, or what sort of changes they are going through. You still own the same number of shares in the company, you don't lose what you bought. |

| 19-12-2020 05:20 | |

| Spongy Iris (1643) |

IBdaMann wrote: Hello Bad In Man, If you want to, "get a share of Amazon's profit," by buying their stock, you're going to have to sell their stock, for a higher price than you bought it for. Amazon does not pay a dividend. Usually public companies that pay dividends to their common stock holders don't appreciate very much in price. If a company is paying too high of a dividend, like 10% per year, it reeks of desperation, and suggests the company is in dire financial condition. Jeff Bezos salary is about $80,000 per year. But he owns a lot of AMZN stock. He sold about $10 billion in AMZN stock in 2020. Let's get a quick snapshot of AMZN's financial condition, as of Sept 30 2020. They made almost $348 billion in sales in the past 4 quarters. This information can be found on their income statement. But how much are their "profits?" Sales minus Expenses. The balance sheet can give you a sense of that. Cash, short term investments, receivables, inventory: $113 billion Accounts Payable, accrued expenses, and all debt and capital leases: $152 billion They owe quite a lot more cash than they can readily access. The financial snapshot tells you, as a company, it's like they are living paycheck to paycheck, just like most everybody else is, and using debt to acquire property and equipment, and help them keep extra cash on hand. Jeff Bezos was probably living pretty much paycheck to paycheck too... until he sold all that stock this past year. Obviously Amazon will never have enough cash to pay all their shareholders for the value of their stocks. That currently sits at $1.62 trillion! If lots of shareholders were to try to sell their stock (to profit as the rightful owners of the company ) the price would have to fall by a lot, to get more shareholders to buy AMZN stock. That's how they make a market. It is a zero sum game you know. The stock market. For every sale there is a purchase. I know it's obvious. But I spell it out because you seem to have a hard time grasping things that are really simple As long as not too many people try to sell their stock in AMZN at once, the illusion of a $1.62 trillion value can continue, and maybe even go higher. But as you know, the only reason to buy AMZN, is because you want to sell it for a higher price. %20(1).png) |

| 24-12-2020 17:15 | |

| Spongy Iris (1643) |

Trump's surprise demand for $2,000 stimulus checks blew up Mitch McConnell's master plan and leaves him in a no-win situation. ... Said Chuck Schumer, We spent months trying to secure $2000 checks but Republicans blocked it Trump needs to sign the bill to help people and keep the government open and we're glad to pass more aid Americans need Maybe Trump can finally make himself useful and get Republicans not to block it again ... This leaves the next move to McConnell, who has for months insisted on a smaller stimulus package and has rejected Democratic proposals for $1,200 checks. He now has two undesirable options: He can cave and accept a larger stimulus figure after fighting for months to keep it down. He can block the larger checks and take the political heat for it. https://twitter.com/realDonaldTrump/status/1341537886315950080?s=20 %20(1).png)

Edited on 24-12-2020 17:18 |

| 24-12-2020 18:43 | |

| HarveyH55 (5196) |

Democrats in the House, are trying to pull off some sort of scam. 5,000 page Bill, bundled with the budget, and defense spending. Puts it at an all or nothing. Why combine all those bills, into the covid relief bill, other than to sneaky in some shady crap. I need to see if there is a copy, just to see what sort of crap they are try to pull this time. |

| 24-12-2020 21:57 | |

| Into the Night (21582) |

HarveyH55 wrote: https://rules.house.gov/sites/democrats.rules.house.gov/files/BILLS-116HR133SA-RCP-116-68.pdf It's the same sort of shit they tried last time and that got shot down in the Senate. You will find the $600 relief in Division N, Title 2, Subchapter VI, Subtitle B, $6428A(a)(1). Oh BTW, there is also language in there to require the federal government to study the banning of internal combustion engines. Gawd. Only Congress could come up with something like this. The Parrot Killer Debunked in my sig. - tmiddles Google keeps track of paranoid talk and i'm not on their list. I've been evaluated and certified. - keepit nuclear powered ships do not require nuclear fuel. - Swan While it is true that fossils do not burn it is also true that fossil fuels burn very well - Swan Edited on 24-12-2020 22:31 |

| 25-12-2020 16:27 | |

| HarveyH55 (5196) |

Into the Night wrote:HarveyH55 wrote: Took 37 minutes, to download 8.6 meg... And what a monstrous mess. Of course, I didn't read all 5,000+ pages, word-for-word. I'm pretty sure few people read it either. Basically, they could be passing anything thing, and hard to catch. |

| 25-12-2020 18:29 | |

| James___★★★★★ (5513) |

Spongy Iris wrote: What's not being said is that the the $1,200 payments cost about $28 Billion. In a $Trillion dollar proposal, one of the smaller items. This specific issue might have more to do with moral. Still, the tax break given to corporations in 10 years could pay for both stimulus packages. But the GOP were looking out for who matters in America. Investors. Edited on 25-12-2020 18:39 |

| 27-12-2020 05:35 | |

| Harry C (157) |

Spongy Iris wrote: Based upon the foregoing quoted items, I would not recommend that you prepare any type of financial snapshot. Profit is measured on the income statement. The balance sheet is a statement of account balances. There is no expense accounting on the balance sheet. It's all on the income statement. Profit is generally termed as gross profit and represents the difference between operating revenue and operating cost but neglects overhead and non-operating items. Earnings or net income is synonymous with net profit. In a nutshell, they had $17Bn in gross profit for the last 12 months. After tax, they had a little over $13Bn in net income that is allocable to the shareholders. They had about $30Bn in cash flow and positive working capital of $8.5Bn. By the numbers there is no financial distress. Now if they're pulling an Enron, that's a horse of another color. Amazon shareholders have made more money off of the appreciation of stock than operations. That will change when they can no longer deliver strong growth. At that point they will be forced to make more money off of operations. Their goal, or mission right now is to build a monolithic organization. Edited on 27-12-2020 05:37 |

| 27-12-2020 06:41 | |

| James___★★★★★ (5513) |

Harry C wrote:Spongy Iris wrote: A part of Amazon's business strategy is not to make money. Since they pay no dividends on their common stock, they grow the company instead. This means they pay little or no corporate taxes. Capitalism 101. |

| 27-12-2020 07:05 | |

| IBdaMann (14389) |

James___ wrote: A part of Amazon's business strategy is not to make money. Man are they failures. James___ wrote:Since they pay no dividends on their common stock, they grow the company instead. Amazon pays taxes on all profit. James___ wrote: This means they pay little or no corporate taxes. Capitalism 101. If by "zero" you mean $billions then yes, they pay zero in taxes. I don't think i can [define it]. I just kind of get a feel for the phrase. - keepit A Spaghetti strainer with the faucet running, retains water- tmiddles Clouds don't trap heat. Clouds block cold. - Spongy Iris Printing dollars to pay debt doesn't increase the number of dollars. - keepit If Venus were a black body it would have a much much lower temperature than what we found there.- tmiddles Ah the "Valid Data" myth of ITN/IBD. - tmiddles Ceist - I couldn't agree with you more. But when money and religion are involved, and there are people who value them above all else, then the lies begin. - trafn You are completely misunderstanding their use of the word "accumulation"! - Climate Scientist. The Stefan-Boltzman equation doesn't come up with the correct temperature if greenhouse gases are not considered - Hank :*sigh* Not the "raw data" crap. - Leafsdude IB STILL hasn't explained what Planck's Law means. Just more hand waving that it applies to everything and more asserting that the greenhouse effect 'violates' it.- Ceist |

| 27-12-2020 07:13 | |

| IBdaMann (14389) |

HarveyH55 wrote: People don't really lose money on their stocks, unless they sell them for less than what they paid. In business, there is a different perspective. Most businessmen adhere to the mantra that they do, in fact, lose what they fail to earn. Economics has the concept of "opportunity costs" which are incurred with every investment or lack thereof. If you buy stock, then you can't avail yourself of any other opportunities with the money you used to buy that stock. If the stock you chose pays you dividends of $100 and the stock you didn't buy with that money pays shareholders $300 then your decision cost you $200, and the category is "opportunity costs." I just wanted to throw that in there. . I don't think i can [define it]. I just kind of get a feel for the phrase. - keepit A Spaghetti strainer with the faucet running, retains water- tmiddles Clouds don't trap heat. Clouds block cold. - Spongy Iris Printing dollars to pay debt doesn't increase the number of dollars. - keepit If Venus were a black body it would have a much much lower temperature than what we found there.- tmiddles Ah the "Valid Data" myth of ITN/IBD. - tmiddles Ceist - I couldn't agree with you more. But when money and religion are involved, and there are people who value them above all else, then the lies begin. - trafn You are completely misunderstanding their use of the word "accumulation"! - Climate Scientist. The Stefan-Boltzman equation doesn't come up with the correct temperature if greenhouse gases are not considered - Hank :*sigh* Not the "raw data" crap. - Leafsdude IB STILL hasn't explained what Planck's Law means. Just more hand waving that it applies to everything and more asserting that the greenhouse effect 'violates' it.- Ceist |

| 28-12-2020 10:37 | |

| Spongy Iris (1643) |

James___ wrote:Harry C wrote:Spongy Iris wrote: Income statements can be misleading. As an example... Money spent on CAPEX purchases is not immediately reported on an income statement. Rather, it is treated as an asset on the balance sheet, that is deducted over the course of several years as a depreciation expense, beginning the year following the date on which the item is purchased. (And in case you don't know... A capital expenditure (CAPEX) is an investment in a business, such as a piece of manufacturing equipment, an office supply, or a vehicle. A CAPEX is typically steered towards the goal of rolling out a new product line or expanding a company's existing operations.) You can't really get a sense how much money is coming in and going out by looking at the income statement. So let's look at the cash flow statement to see the change in their cash on hand over the years for AMZN. 2016: $19 billion 2017: $21 billion 2018: $32 billion 2019: $36 billion And now let's look at their total debt and capital lease obligations in the same years 2016: $23 billion 2017: $51 billion 2018: $56 billion 2019: $103 billion Amazon is growing their debt a lot faster than their cash. They may be growing their sales, but they are losing money in the process. %20(1).png)

Edited on 28-12-2020 10:41 |

| 28-12-2020 11:36 | |

| IBdaMann (14389) |

Spongy Iris wrote: Income statements can be misleading. Of course. All accounting can and will be as "misleading" as any infomercial. This is because all corporations have two sets of books: one for regulatory reporting to the government and a different one for shareholders that portrays the rosiest picture possible. . I don't think i can [define it]. I just kind of get a feel for the phrase. - keepit A Spaghetti strainer with the faucet running, retains water- tmiddles Clouds don't trap heat. Clouds block cold. - Spongy Iris Printing dollars to pay debt doesn't increase the number of dollars. - keepit If Venus were a black body it would have a much much lower temperature than what we found there.- tmiddles Ah the "Valid Data" myth of ITN/IBD. - tmiddles Ceist - I couldn't agree with you more. But when money and religion are involved, and there are people who value them above all else, then the lies begin. - trafn You are completely misunderstanding their use of the word "accumulation"! - Climate Scientist. The Stefan-Boltzman equation doesn't come up with the correct temperature if greenhouse gases are not considered - Hank :*sigh* Not the "raw data" crap. - Leafsdude IB STILL hasn't explained what Planck's Law means. Just more hand waving that it applies to everything and more asserting that the greenhouse effect 'violates' it.- Ceist |

| 28-12-2020 18:05 | |

| James___★★★★★ (5513) |

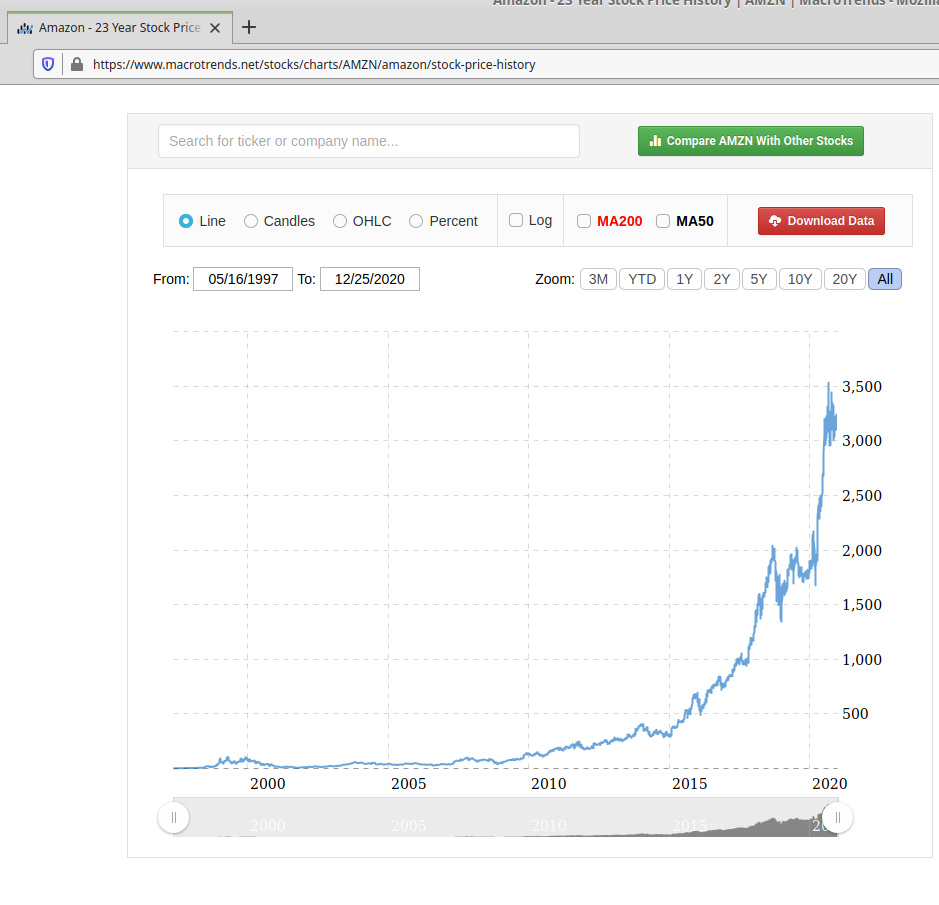

Spongy Iris wrote: Anymore the wealthy expect to be subsidized. As far as Amazon losing money, they're gaining market share. When they slow their expansion which requires investments, they'll be profitable. And they could end up paying no federal taxes. The objective is to raise the value of their stock. That's good for investors. This link shows Amazon stock is now worth over $3,000 a share. Before 2010, less than $142 a share. Just scroll down a little to see the graph. https://www.macrotrends.net/stocks/charts/AMZN/amazon/stock-price-history Attached image:  |

| 28-12-2020 18:30 | |

| gfm7175 (3314) |

IBdaMann wrote:HarveyH55 wrote: People don't really lose money on their stocks, unless they sell them for less than what they paid. ... and this is the very concept that people (typically TDS infected liberals) who think that President Trump is "making a shit ton of money off of becoming President" do not understand. They don't understand that Trump's "opportunity costs", from his choice to become a Presidential candidate (and subsequently getting the job!) rather than simply continuing onward with his 'successful businessman life', easily exceed a billion dollars (I'd even say multiple billions). Sure, someone like Barack Obama actually did "make a shit ton of money off of becoming President" due to his revenues from speeches, book deals, and the like... but he didn't suffer anywhere near the opportunity costs that Trump did, so he ended up making a bunch of money while Trump ended up losing a bunch of money. What Trump decided to freely give up in exchange for fighting for the well-being of this country is truly commendable. |

| 28-12-2020 19:16 | |

| James___★★★★★ (5513) |

@Spongy, in 2017, President Trump lowered the corporate tax rate from 35% to 21%. Look at Amazon's stock prices before and after that legislation was passed. Granted the pandemic further increased it's value but going up 4Xs as a result of President Trump's legislation shows that investors made a lot of money. What's overlooked is that many people who think they got a tax break merely had the amount of federal taxes withheld reduced while receiving a significantly smaller tax return at the end of the year. People on Yahoo talked about this when comments were allowed. Yet people can't admit to being duped. @GFM, no one knows why Trump is worth an estimated $2.5 Billion. What if $500 million or more is invested in stock? Then he stood to make hundreds of millions of dollars by lowering the corporate tax rate. At the same time, Obama became worth about $20 Million by having served as president. Trump stands to profit over 10X's what Obama did from being president. Edited on 28-12-2020 19:57 |

| 28-12-2020 21:26 | |

| IBdaMann (14389) |

James___ wrote:@GFM, no one knows why Trump is worth an estimated $2.5 Billion. Who is required to know? Who has a Constitutional right to know? This is exactly who does know. James___ wrote: What if $500 million or more is invested in stock? Then he stood to make hundreds of millions of dollars by lowering the corporate tax rate. I need you to be clear. Is it wrong for a President to benefit all Americans since he himself would also benefit? Should a President only benefit a small set of special interest groups of which he is not a member? . I don't think i can [define it]. I just kind of get a feel for the phrase. - keepit A Spaghetti strainer with the faucet running, retains water- tmiddles Clouds don't trap heat. Clouds block cold. - Spongy Iris Printing dollars to pay debt doesn't increase the number of dollars. - keepit If Venus were a black body it would have a much much lower temperature than what we found there.- tmiddles Ah the "Valid Data" myth of ITN/IBD. - tmiddles Ceist - I couldn't agree with you more. But when money and religion are involved, and there are people who value them above all else, then the lies begin. - trafn You are completely misunderstanding their use of the word "accumulation"! - Climate Scientist. The Stefan-Boltzman equation doesn't come up with the correct temperature if greenhouse gases are not considered - Hank :*sigh* Not the "raw data" crap. - Leafsdude IB STILL hasn't explained what Planck's Law means. Just more hand waving that it applies to everything and more asserting that the greenhouse effect 'violates' it.- Ceist |

| 28-12-2020 21:49 | |

| James___★★★★★ (5513) |

IBdaMann wrote:James___ wrote:@GFM, no one knows why Trump is worth an estimated $2.5 Billion. IBDM, you guys got duped by him. You should own up to it. Myself, I think between the DNC and the GOP that America is basically screwed. Edited on 28-12-2020 21:56 |

| 28-12-2020 21:54 | |

| gfm7175 (3314) |

James___ wrote: What did I just get done saying about opportunity cost with regard to this? Do you not realize at least some of what Trump has given up by becoming President? Did Obama also have to give up those things? |

| 28-12-2020 21:57 | |

| gfm7175 (3314) |

James___ wrote: I don't belong to either political party either. We don't register by political party here in Wisconsin. |

| 28-12-2020 22:06 | |

| James___★★★★★ (5513) |

gfm7175 wrote:James___ wrote: I checked, you can. But your posts show that you support the GOP or at least Trump. That gets old. Trump, Trump, Trump, Trump. This kind of shows what a joke the GOP has become. Yet you and your friends will support it. https://www.yahoo.com/news/republicans-sue-mike-pence-desperate-173200942.html Edited on 28-12-2020 22:10 |

| 28-12-2020 22:13 | |

| IBdaMann (14389) |

James___ wrote:IBDM, you guys got duped by him. You should own up to it. Myself, I think between the DNC and the GOP that America is basically screwed. Before you pull a tgoebbles-3, let's answer the following: James___ wrote: What if $500 million or more is invested in stock? Then he stood to make hundreds of millions of dollars by lowering the corporate tax rate. I need you to be clear. Is it wrong for a President to benefit all Americans since he himself would also benefit? Should a President only benefit a small set of special interest groups of which he is not a member? . I don't think i can [define it]. I just kind of get a feel for the phrase. - keepit A Spaghetti strainer with the faucet running, retains water- tmiddles Clouds don't trap heat. Clouds block cold. - Spongy Iris Printing dollars to pay debt doesn't increase the number of dollars. - keepit If Venus were a black body it would have a much much lower temperature than what we found there.- tmiddles Ah the "Valid Data" myth of ITN/IBD. - tmiddles Ceist - I couldn't agree with you more. But when money and religion are involved, and there are people who value them above all else, then the lies begin. - trafn You are completely misunderstanding their use of the word "accumulation"! - Climate Scientist. The Stefan-Boltzman equation doesn't come up with the correct temperature if greenhouse gases are not considered - Hank :*sigh* Not the "raw data" crap. - Leafsdude IB STILL hasn't explained what Planck's Law means. Just more hand waving that it applies to everything and more asserting that the greenhouse effect 'violates' it.- Ceist |

| 28-12-2020 22:24 | |

| James___★★★★★ (5513) |

IBdaMann wrote:James___ wrote:IBDM, you guys got duped by him. You should own up to it. Myself, I think between the DNC and the GOP that America is basically screwed. This is where you guys are delusional. |

| 28-12-2020 23:17 | |

| Spongy Iris (1643) |

James___ wrote:Spongy Iris wrote: I'm sorry James, but you just invited the forecast of Spongy Iris Blog Spot. Don't worry, as Duncan knows, the forecasts of climate alarmists are always wrong. We can be near certain this one will be too. *** In chaos, the same patterns are found in different scales. The patterns that emerge on a small scale are the same kinds of patterns that emerge on a large scale. An often denied, or disregarded, reality of the stock market is that it is a zero sum game. Whatever one party is taking, an equal and opposite party has to be giving. There is no money in the stock market, just temporary transfers between accounts, which must equal zero. A VIP player in the game of stocks is a market maker, who is usually a large bank and/or hedge fund. A market maker keeps an inventory of stock positions, and moves the prices of stocks in their inventory up and down, through buying and selling their inventory at prices they quote. Buyers and sellers speculate based on the prices they have seen quoted (which are predominantly market maker quotes), when the best times are to buy stocks at a lower price, so they can be sold for a higher price at a later time (or when the best times are to "go short" and sell stocks at a higher price, so they can be bought at a lower price at a later time). Market makers pay stock brokers for order flow information on account holders buying and selling of stocks. When an order is cleared, the buyer pays slightly more than the seller gets, and the market maker gets the difference. A market maker must quote prices in a manner that makes a market, so they can find the right amount of buyers and sellers to clear their inventory of stock positions over time. In general, it seems a major tactic to getting this done, is to quote prices upward slowly over a longer time period than most people anticipate, or, to quote prices down quickly over a shorter time period than most people anticipate. If a stock is rising more than it falls over time, more and more people will want to buy that stock, and more and more buyers will flood the orders, over time, because that stock is a winning bet. As price gains happen over a long period of years or decades, more and more people start to sell for a profit. The price then starts to drop at a much faster rate than it had risen. Slowly stocks are being bought. Then quickly stocks are being sold. It usually seems like those with more money bought near the bottom, and those with the less money bought near the top. As they say, "the stock market is a rich man's game." Many times, a stock price drops quite a lot, perhaps 33%, or 66%, but then it seems new buying interest is generated, and the price begins rising again, often to make new highs. The nature of the beast seems to always run into the dillemma eventually, where the buyers with more money who bought at the bottom start selling, and those with less money buying at the top cannot offset those sales. The job of the market maker is to keep enough inventory on hand to clear these kinds of imbalances. Dropping prices fast is a good way to buy more inventory; and raising prices slow is a good way to sell more inventory. It seems like market makers are usually buying stocks when most others are selling them, and selling stocks when most others are buying them. As long as prices are rising, there should be buying interest. The only reason to buy a stock is because you want to sell it for a gain later on. But, when too many people try to sell their stocks, the price must fall by a large order of magnitude, in order to make a market with enough buyers to offset the sellers. And if prices are falling, there becomes less and less buying interest. Without buying interest there can be no market. It is forecast, because more "poor" people will lose money during the fast declines, and less "rich" people with gains will cash out, buying interest should become zero by 2025. The above pattern is very typical for individual stocks over a shorter time period. Here it is projected for all stocks over a longer time period. The length of time of the growth periods increases exponentially in years: From 1920 to 1930: 10 years From 1950 to 1970: 20 years From 1980 to 2020: 40 years And it is predicted, the length of time of the decay periods will be decreasing exponentially in years: From 1930 to 1950: 20 years From 1970 to 1980: 10 years (From 2020 to 2025: 5 years) In chaos, the same patterns are found in different scales. The patterns that emerge on a small scale are the same kinds of patterns that emerge on a large scale. %20(1).png) |

| 28-12-2020 23:29 | |

| James___★★★★★ (5513) |

Spongy, I'll need to read your post a few more times. I just want to make sure of what you're saying. So a reply will be a couple of days away. With that said, what's your opinion about this? I've read about it before. As for your post, this might have little influence on it. It's more about profiting from short term trading. And when people wonder why day traders lose money, this would be why. In the short term, these traders would most likely make stock prices volatile for everyone except for themselves. And that's where what you posted seems to be about long term trends. https://www.technologyreview.com/2009/12/21/207034/trading-shares-in-milliseconds/ Edited on 28-12-2020 23:32 |

| 28-12-2020 23:41 | |

| gfm7175 (3314) |

James___ wrote:gfm7175 wrote:James___ wrote: Ummm, I live here, and no you can't. There is no "registering by party affiliation" here in Wisconsin. There is only "registering as a voter". James___ wrote: Yes, I do support Trump (very strongly, I might add), and I do support a few of the other GOP members as well (Govs Ron DeSantis and Kristi Noem have both done a good job in their States, especially with regard to the covid scamdemic, for a couple examples). There are very few Democrats who I will find myself in agreement with, at least once in a blue moon, (such as Tulsi Gabbard [opposes ballot harvesting], Russ Feingold [the only senator at the time who voted against the Patriot Act], and Vernon Jones [stood side by side with Trump and other patriots, fighting against the 2020 election theft] are a few examples), and there was only ever one "Democrat" who I fully supported (ex Police Chief David Clarke, although he only ran as a Democrat because that's the only way that one can get themselves elected in Milwaukee County), but such instances of agreement with Democrats (especially nowadays) are very few and far between and are typically with regard to very hyper focused and specific claims/positions. James___ wrote: The word Trump NEVER gets old to me. If it were played in my ear (on loop) 24/7/365 for the rest of my life, my life would be complete! James___ wrote: |

| 28-12-2020 23:44 | |

| gfm7175 (3314) |

James___ wrote:IBdaMann wrote:James___ wrote:IBDM, you guys got duped by him. You should own up to it. Myself, I think between the DNC and the GOP that America is basically screwed. @ IBD, Looks like James has decided to pull a 'keepit' instead... |

| 28-12-2020 23:55 | |

| IBdaMann (14389) |

James___ wrote:This is where you guys are delusional. Very disappointing. You are opting to tip your king rather than answer an easy question that drives home how you were mistaken on one little point. By the way, when did I become a plural? gfm7175 wrote:@ IBD, Sad but true. I double-checked and my question was NOT overly difficult. Maybe my complete question . I don't think i can [define it]. I just kind of get a feel for the phrase. - keepit A Spaghetti strainer with the faucet running, retains water- tmiddles Clouds don't trap heat. Clouds block cold. - Spongy Iris Printing dollars to pay debt doesn't increase the number of dollars. - keepit If Venus were a black body it would have a much much lower temperature than what we found there.- tmiddles Ah the "Valid Data" myth of ITN/IBD. - tmiddles Ceist - I couldn't agree with you more. But when money and religion are involved, and there are people who value them above all else, then the lies begin. - trafn You are completely misunderstanding their use of the word "accumulation"! - Climate Scientist. The Stefan-Boltzman equation doesn't come up with the correct temperature if greenhouse gases are not considered - Hank :*sigh* Not the "raw data" crap. - Leafsdude IB STILL hasn't explained what Planck's Law means. Just more hand waving that it applies to everything and more asserting that the greenhouse effect 'violates' it.- Ceist |

| 29-12-2020 00:05 | |

| gfm7175 (3314) |

IBdaMann wrote:James___ wrote:This is where you guys are delusional. He must be speaking Liberal again... Apparently in Liberal, 'I' can switch from being a singular to a plural (and vice versa) at one's instantaneous whim. It is quite the language... Of course, in English, 'I' is always a singular. IBdaMann wrote:gfm7175 wrote:@ IBD, I didn't think it was all that difficult either. Oh well! Maybe next time you Edited on 29-12-2020 00:07 |

| 29-12-2020 00:20 | |

| Into the Night (21582) |

Spongy Iris wrote: The stock market is not a zero sum game. Capitalism creates wealth. The Parrot Killer Debunked in my sig. - tmiddles Google keeps track of paranoid talk and i'm not on their list. I've been evaluated and certified. - keepit nuclear powered ships do not require nuclear fuel. - Swan While it is true that fossils do not burn it is also true that fossil fuels burn very well - Swan |

| 29-12-2020 00:29 | |

| James___★★★★★ (5513) |

Into the Night wrote:Spongy Iris wrote: The stock market crash of 1929 suggests otherwise. The stock market simply took money out of the economy. |

| 29-12-2020 01:05 | |

| Spongy Iris (1643) |

Into the Night wrote:Spongy Iris wrote: Money ain't a thing. For everything bought there is an equal amount sold. All sales minus all expenses are zero. %20(1).png) |

| 29-12-2020 01:10 | |

| James___★★★★★ (5513) |

Spongy Iris wrote:Into the Night wrote:Spongy Iris wrote: Your statement is correct. It does not account for an increase in the cost of what is being bought. This increase is always considered as inflation. |

| 29-12-2020 01:18 | |

| Spongy Iris (1643) |

James___ wrote:Spongy Iris wrote:Into the Night wrote:Spongy Iris wrote: Inflation is the result of inequality in the zero sum game that is money. I'm sorry to have to copy paste my novel again: Say there are 1,000 people in a workforce. $300 is the price for each person to buy what they need in 1 year. By year end, $300,000 is spent and $300,000 is earned. But the management class takes the lion's share of the available earnings 100 people get paid $450 per year. 900 people get paid $283.33 per year. 900 people need an extra $16.67 by year end. 100 people have an extra $150 by year end. At the end of the year there is savings of $15,000 and a deficit of $15,000 The 900 people will need to get credit cards, mortgages, or other loans to cover their expenses of $300. (Also consider, money originally gets put into circulation as a loan from a bank, to businesses, and to individuals, as a principal amount, and the bank will try to collect the principal amount plus interest.) If the 100 people spend all their $450 in the course of the year, and all else is constant, there is $315,000 spent, and it will then take $315 for everybody to buy what they need. The net prices of everything people need will have risen 5% in the course of the year. After so many years of this, when the loans cannot be repaid, more loans can be made to cover the shortfall, or loans can default, or the debt can be repudiated. %20(1).png) |

| 29-12-2020 01:23 | |

| James___★★★★★ (5513) |

That's okay that you post from your work. I've posted before a basic mathematical model. It showed what allows for an economy. To consider an economic model, it takes time. It wouldn't be possible for me to say today what I think of your work. A response takes time while a reaction just happens. Hopefully you've noticed that I will not shy away from math. It's not the answer but it helps to understand trends. 2 different things. |

| 29-12-2020 01:23 | |

| Into the Night (21582) |

Spongy Iris wrote:James___ wrote:Spongy Iris wrote:Into the Night wrote:Spongy Iris wrote: Money is not a zero sum game either. The Parrot Killer Debunked in my sig. - tmiddles Google keeps track of paranoid talk and i'm not on their list. I've been evaluated and certified. - keepit nuclear powered ships do not require nuclear fuel. - Swan While it is true that fossils do not burn it is also true that fossil fuels burn very well - Swan |

| 29-12-2020 01:27 | |

| James___★★★★★ (5513) |

Into the Night wrote:Spongy Iris wrote:James___ wrote:Spongy Iris wrote:Into the Night wrote:Spongy Iris wrote: Without inflation or deflation, barter is a zero sum transaction. Kind of why interest is charged on debt. Duh!! p.s., Rod Carew won 7 batting titles thinking, I can get a hit. Not arrogance, just knew why he was in the batter's box. To interject some fun into this discussion; https://www.youtube.com/watch?v=v2AC41dglnM Edited on 29-12-2020 01:44 |

Join the debate Is Mitch McConnell Being Played?:

Related content

| Threads | Replies | Last post |

| The Power That Mitch has | 2 | 01-10-2019 11:22 |

| Dozens of Youth Activists Arrested After Green New Deal Protest in Mitch McConnell's Office | 2 | 26-02-2019 20:25 |